Member Outcomes Assessment

TelstraSuper is committed to supporting our members to grow and protect their super and optimise their income streams.

Read the full Annual Outcomes Assessment for MembersTelstraSuper is committed to supporting our members to grow and protect their super and optimise their income streams.

Read the full Annual Outcomes Assessment for MembersWe recently reviewed the overall Fund performance and the performance of individual products and services and how suitable they are for you – our members – for the financial year to 30 June 2021. The key elements were all assessed both in terms of objectives and compared to other funds. Read the full Annual Outcomes Assessment for Members.

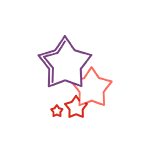

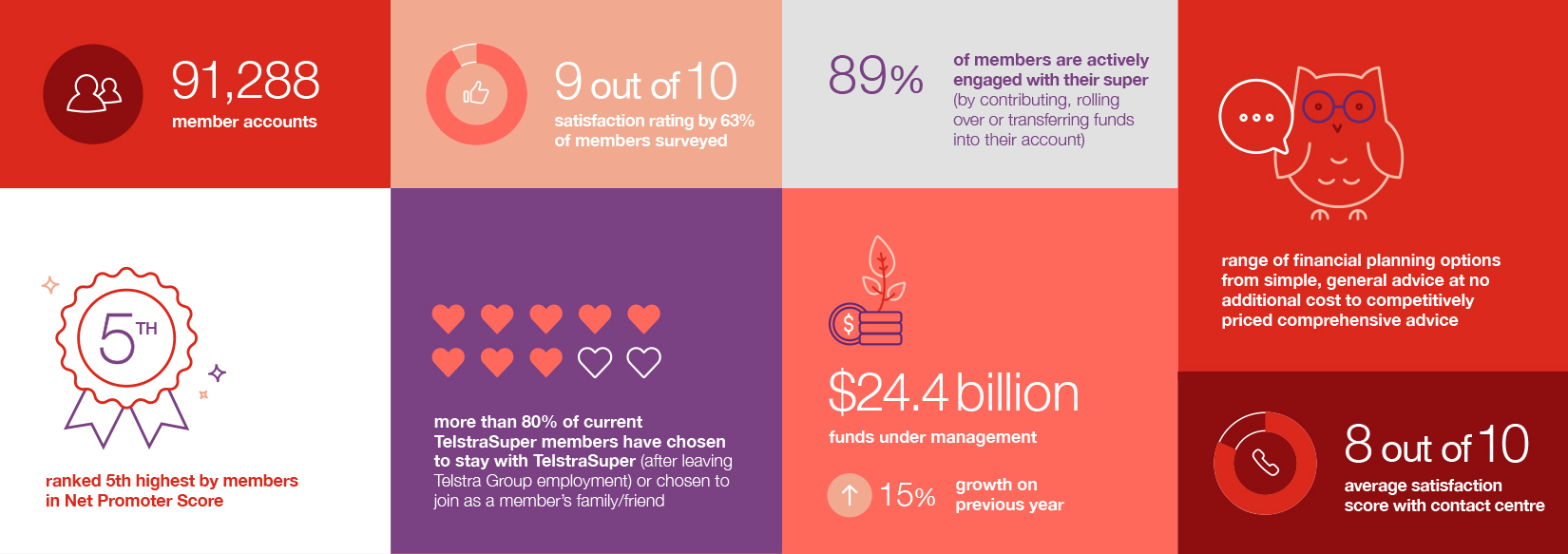

TelstraSuper’s sole objective is to help our members achieve a financially secure future, which we’ve achieved for more than 31 years. We’re achieving our strategy of providing high quality products and services at a fair cost.

Funds under management grew strongly to $24.4 billion in the year to 30 June 2023, making TelstraSuper one of the largest super funds in the industry. This growth will enable the Fund to retain sufficient scale in assets to remain a competitive and sustainable fund.

TelstraSuper is well positioned to continue to provide strongly supported and competitive outcomes for members as they are accumulating super and in the retirement phase. The scale and sustainability can provide advantage and reassurance for members that their retirement savings are professionally managed by a highly trusted fund and will continue to be into the future. Our scale enables us to design products specific to the characteristics of our members.

Overall, TelstraSuper has generally delivered strong investment outcomes relative to our objectives and our peers over multiple time periods and the Trustee determined that the investment strategy, including the level of investment risk and return targets across each option, is appropriate for members.

All MySuper and Choice Accumulation investment options and all RetireAccess options performed above their stated objectives for the year for each product. This is an excellent result for our members and confirms that our investment performance has delivered on the objectives set.

Performance relative to peer super funds has also generally been favourable (better than median) for most of our investment options over multiple time horizons.

TelstraSuper provides products, services and benefits that are highly regarded by members and are rated highly by rating agencies.

Overall, the investment performance and net returns for the year were good, and competitive compared to the industry for most products.

The fees compared competitively across the industry with fees below the median in some areas and on, or slightly above, in others.

All of the MySuper accumulation product options performed above their stated objectives. When compared to other MySuper products that would apply at each age range, the investment performance of the MySuper Growth option is top quartile across all time periods, with My Super Balanced in the second and third quartiles.

Most of the Choice investment options delivered investment performance for the 1, 3, 5, 7 and 10 year periods to 30 June 2021 that was in the first or second quartile, when compared to similar funds, with the Conservative option in the first quartile for all time periods. The Choice options are compared on a risk level basis with other investment products with a similar risk level.

The RetireAccess product delivered strong top quartile performance over 10 years for the Balanced, Conservative, Diversified Income, Defensive Growth and Property options.

The Defined Benefit divisions are closed to new members and all defined benefits are fully funded with the average benefit for members well above the industry average.

TelstraSuper aims to provide members with a sustainable, high quality and competitively priced insurance product. The objective is to protect members against the risk of not being able to accumulate sufficient retirement savings, for themselves or their dependents, due to having to cease work due to injury, illness or death.

The Trustee has determined that the insurance coverage compares favourably with other providers across most metrics, that the insurance strategy is appropriate for members and that the fees for default insurance do not inappropriately erode the retirement incomes of members. Ratings agency Chant West has rated TelstraSuper’s insurance as being the Highest Quality with a ‘5 Apples’ rating.

TelstraSuper provides a broad range of high-quality services to support members in all aspects of their super and help them achieve the best retirement outcomes for their needs.

Digital services: website, mobile app, online portal, tools, calculators

86% of members registered for SuperOnline, compared to an industry average of 52%, with an average of 150,000 logins each month and 8.7 out of 10 member satisfaction rating. Mobile app usage increased 20%. Website satisfaction rated 8.5 out of 10.

Contact centre

Internally hosted contact centre with a satisfaction rating of 8.2 out of 10. Outbound calls team proactively contacts members at key life stages with 9.1 out of 10 satisfaction.

Financial advice

Full advice service ranging from simple phone based to comprehensive advice.

Member education

Offered both online and in-person for member convenience and flexibility. High satisfaction of 8.2 out of 10 for education seminars.

Tailored communication and information

Regular emails and newsletter, tailored to members’ lifestages, plus twice-yearly statements.

TelstraSuper is delivering on the intended outcomes for members. The long-term scale and sustainability of the Fund, directed by the current fund strategy, is expected to remain competitive.

For TelstraSuper’s MySuper products, Choice products, Defined Benefits and RetireAccess Allocated Pensions, the Trustee determined that the financial interests of members are being promoted by the Trustee.

Read our Annual Outcomes Assessment for Members to find out more.