Your super performance: focusing on the long-term

July 18, 2022

Last financial year investment markets globally and in Australia saw some of the biggest gains in superannuation history. TelstraSuper also had the strongest returns in our 31 years of managing our members' super.

This financial year, unfortunately the story is different. Investment returns are down significantly on this time last financial year across the wider superannuation industry, primarily because of global events and changing economic conditions.

Our diversified investment options which have allocations to Australian and International shares have been negatively impacted by falling markets.

Fixed interest assets have also been under-performing because interest rates have been increasing. Fixed interest often provides some protection against share market downturns, but hasn’t done so in the current environment due to the recent sharp rises in interest rates.

Find out why fixed interest is performing poorly

What’s happening to investment markets

Investments were performing reasonably well this financial year until the end of 2021. The last six months have been a bit more of a roller coaster ride.

A combination of factors has led to recent volatility across local and global investment markets. Geopolitical tensions (for example the current Ukraine/Russian tensions) are high and inflation is accelerating in many parts of the globe, including Australia. Further, China’s “zero COVID” stance has resulted in lockdowns which have negatively affected supply chains and China’s inflation and growth forecasts. These factors are likely to be further compounded by most central banks signalling a more hawkish stance (i.e. more prepared to raise interest rates) going forward. The impact of these factors has led to the recent bout of heightened volatility, which may well persist for some time.

This means that investment returns at the end of this financial year are lower than last year and are negative for most diversified investment options.

Top 10 performance for the Balanced and Conservative option

While returns across the superannuation industry are lower this financial year, TelstraSuper’s diversified options have all performed better than most Australian super funds – our investment returns for all our MySuper investment options are above median in the SuperRatings survey for the financial year 30 June 2022* and several investment options are in the top quartile for performance for the financial year.

Our Balanced and Conservative options were top 10 performers over the 1 year period to 30 June 2022.^ This is when ranked against the top 50 super funds in Australia. This result means the TelstraSuper Balanced and Conservative options are one of the best performing over the 12 month period in the country. The Conservative option was also ranked first for 10 years ending 30 June 2022.

Our Chief Investment Office, Graeme Miller, provides an update on markets in this video.

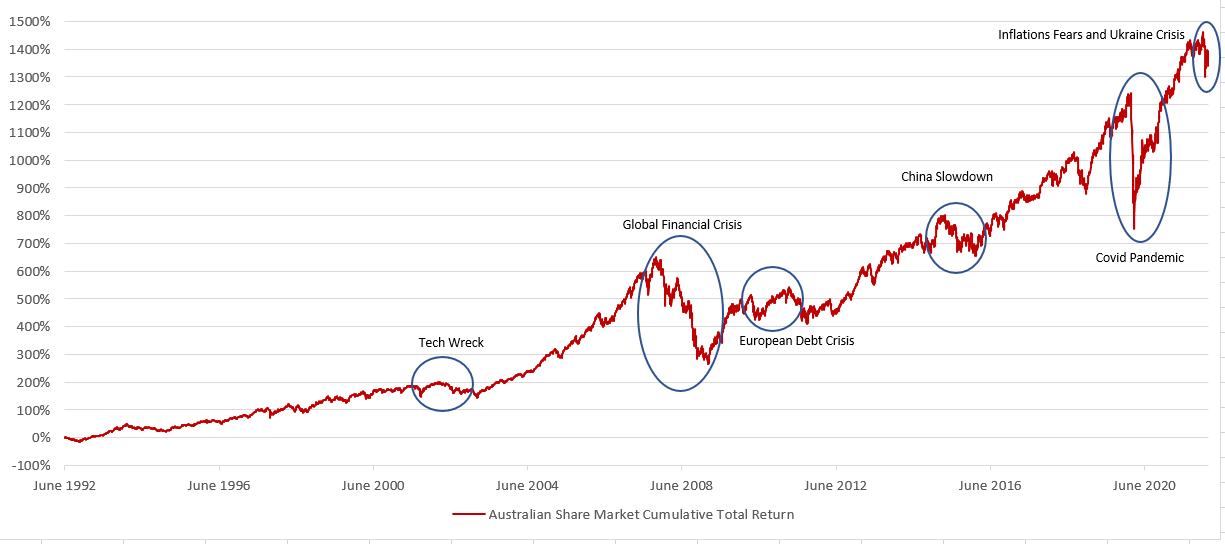

Focus on the long-term

Financial years like the one we are having can cause anxiety, but our investment team prepare for scenarios like this, and while your balance may decrease in the short term, we are still well on track to meeting our long-term investment objectives. Remember that superannuation is a long-term investment, where the performance of your investment should be measured over long term periods and not in the short term.

Returns to 30 June 2022

Accumulation (Corporate Plus and Personal Plus & TTR income stream)

| Option | 1 Year | 5 years | 10 years |

| Conservative | -0.85% | 4.07% | 5.90% |

| Balanced | -1.87% | 6.01% | 8.45% |

| Growth | -3.13% | 7.02% | 9.62% |

The following shows the performance of our three main diversified options over several periods. This shows what $100,000 would be worth if you invested it over the following periods. While the short-term has been negative, the long-term remains strong.

Growth of $100,000 if invested over 1, 10 and 20 years to 30 June 2022

| Investment option | 1 year (invested on 30 June 2021) |

10 years (invested on 30 June 2012) |

20 years (invested on 30 June 2002) |

| Conservative | $99,150 | $177,437 | $310,688 |

| Balanced | $98,127 | $250,077 | $409,257 |

| Growth | $96,874 | $250,660 | $432,387 |

Should you switch investments?

We always caution members to avoid making knee-jerk investment decisions during periods of volatility and instead, seek to put the recent market movements in the context of their long-term investment objectives.

Share markets fluctuate in their value because stocks can be bought and sold quite quickly. Being so easy to convert into cash makes shares susceptible to the general market mood and investor sentiment at any particular time.

It’s important to keep in mind that while periodic negative returns in share markets are not welcome, they are normal, and super funds factor them in when developing their long-term investment strategies.

What is TelstraSuper doing with their investments to minimise the impact?

- We build our portfolios with the goal of generating positive long-term real returns.

- Our options are diversified across many asset classes, meaning the risk is spread across different countries, markets, sectors and asset classes

- TelstraSuper makes use of a dynamic asset allocation approach in which the Fund alters its exposure to asset classes based on fundamental outlook, valuation and sentiment.

- Progressively over 2021, we started to adjust our portfolios towards a more conservative asset allocation stance, as equity markets rose and we became aware of rising potential risks. We did this by selling part of our share portfolios and holding more cash. This action has thus far delivered a measure of protection against the recent market volatility.

Over this financial year, we have also been holding substantially less fixed interest than our long-term targets in most of our investment options, and this has also provided some protection against the recent weaknesses in fixed interest markets.

When will markets recover?

While no one can say how investments will perform in the future, the current economic conditions which are causing inflation and interest rates to rise mean we expect market volatility to remain for some period of time. We cannot predict whether the worst of the market falls are behind us and this is why our current investment positioning is more conservative than it was at this time last financial year.

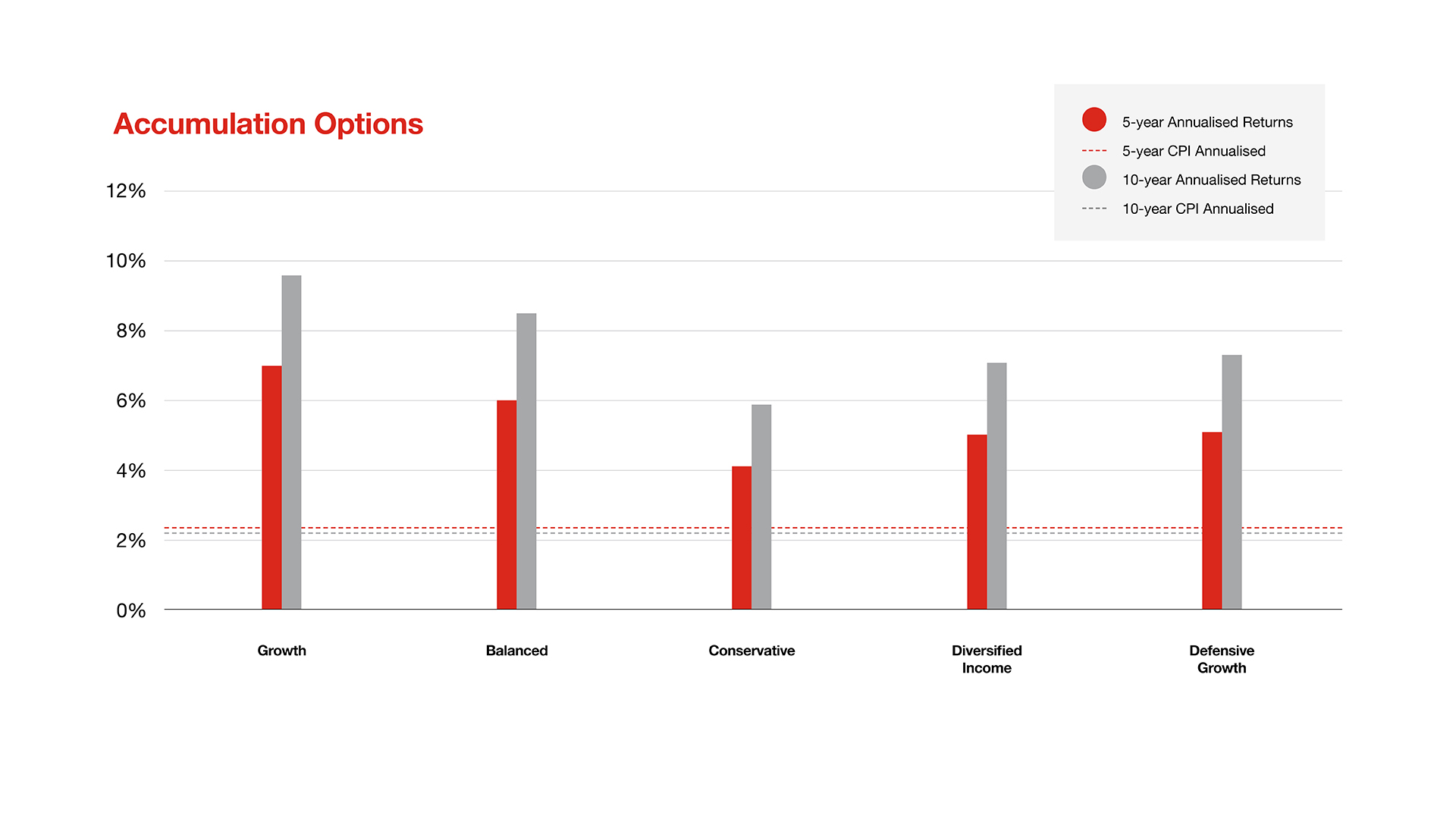

Every investment option has performance objectives, which are generally expressed as exceeding CPI inflation by a margin over a specified time period. Please see our website for the specific performance objective for each option. We continue to meet these objectives over the longer-term. The chart below shows our performance over 5 and 10 years compared to CPI over the same periods with the returns comfortably above inflation.

It is worth noting however that the combination of increasing interest rates and rising inflation coupled with the expectation of lower returns means the ability to meet these performance objectives could be impacted over the short to medium-term. In other words, we think that it will be more difficult, but certainly not impossible, to achieve these performance objectives in the medium term, given current market conditions. We want to assure our members that we have a team of investment professionals that actively manage your super savings and will continue to look for opportunities in the current markets to maximise the likelihood of achieving our performance objectives.

As a member of TelstraSuper, you can receive phone advice about your investments as part of your membership. Call 1300 033 166 to speak with an Adviser.

Our Chief Investment Officer, Graeme Miller, will give an update on investment performance and answer some of the questions our members are asking at webinars in July and August.

You can submit questions in advance, and we’ll look to answer these at the webinars or in future articles.

* Based on Monthly SuperRatings Fund Crediting Rate Survey Comparison over a one and 10 year period up to 30 June 2022, which you can only access by registering on the SuperRatings website. For further information about SuperRatings ratings and methodologies go to superratings.com.au

^ www.lonsec.com.au/super-fund/2022/07/15/best-performing-balanced-super-funds-for-2022-financial-year