Making contributions in retirement

May 16, 2022

Once you’ve reached retirement age, there are rules about how you can continue to contribute to your super while you’re still working. This often means retirees can no longer boost their super.

Changes to the work test from 1 July 2022

Before 1 July 2022 if you’re aged between 67 and 74 and you wanted to make extra contributions you needed to meet the work test. The work test age will be increased from 67 to 75 from 1 July. The change allows older workers and retirees greater flexibility when contributing to their super without having to satisfy the work test.

What is the work test?

To contribute to your super, you must be employed. After you reach retirement age, currently 67, you will be required to meet the work test to prove your employment.

To satisfy the work test between 67 and until you turn 75 years old, you must complete at least 40 hours of paid work during a consecutive 30-day period in the financial year in which you plan to make a super contribution. You must be paid for this work. This could include jobs such as babysitting, cleaning, lawnmowing, gardening, consulting, or other paid employment. Volunteer work doesn’t count towards the work test.

From 1 July you only need to meet the work test once you turn 75.

Example

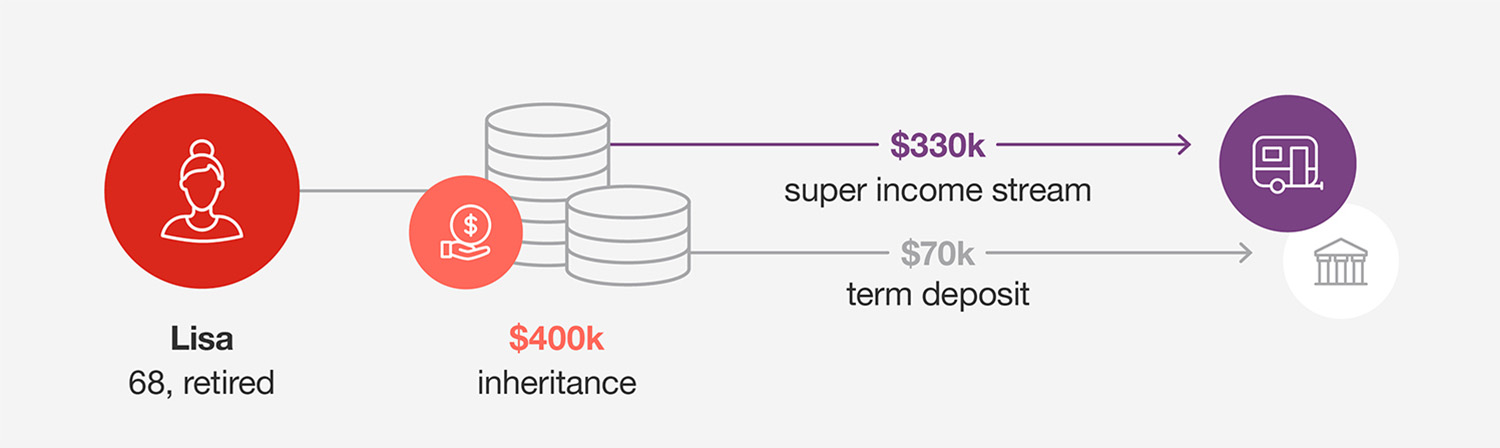

Lisa is 68 and has been retired for the past few years and draws her income from an income stream. She recently received an inheritance of $400,000. Under the previous rules Lisa couldn’t put any of this into super. From 1 July 2022 Lisa can put up to $330,000 into a new income stream or an accumulation account using the bring-forward rule that allows you to contribute three years’ worth of post-tax contributions in one year.

Lisa decides to put the money into an income stream and puts the remaining $70,000 into a term deposit outside of super. Lisa could then put the remaining $70,000 into super when she turns 72 and still not have to meet the work test.

Need help boosting your super?

You can speak with an Adviser from TelstraSuper Financial Planning about how to best boost your super if you are in retirement. You can speak with an Adviser by calling 1300 033 166 or by requesting a call back online.