Your Dashboard has had a facelift

February 9, 2018

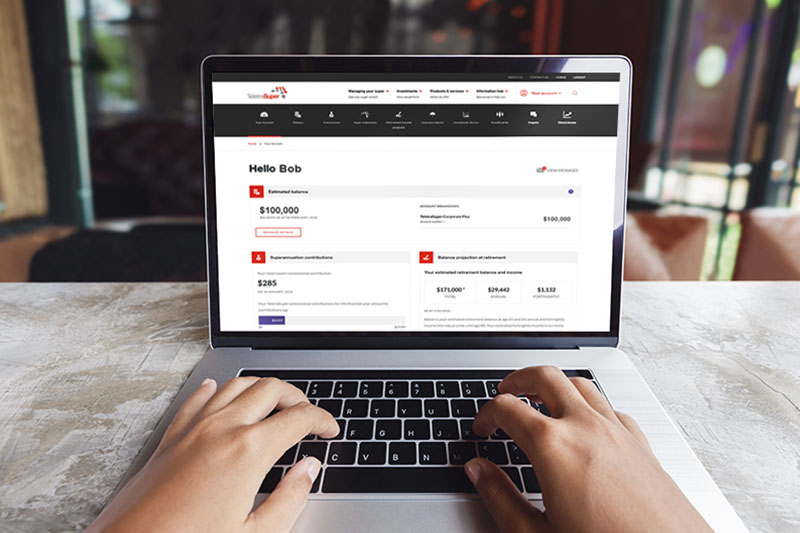

When you next log in to our secure online portal, SuperOnline, you'll notice some great new improvements to your Dashboard.

Balance projection at retirement

Eligible* members will now see a new, industry-leading 'Balance projection at retirement' which displays your current estimated retirement balance and the annual/fortnightly income this will provide. A simple graph puts this in context by displaying how your fortnightly income is tracking against the ASFA target for a comfortable retirement†.

If your estimated retirement balance is lower than you’d like, help is at hand. With the click of a button you can see the difference extra fortnightly contributions of $20/$40/$60 would make to your retirement balance and income. Or, click 'How to boost your super' for further balance-boosting strategies.

Your estimated retirement balance and income is calculated using the TelstraSuper Retirement Income Projector, including some default assumptions (for contributions, investment returns, fees and costs, inflation and for the annual and fortnightly income amounts, the available Government pension entitlements) and some of your personal information (including your current age, account balance, and annual salary if over $60,000, or a default salary of $60,000 if not). To adjust the Assumptions or add in further personal details such as your spouse's super, or other income or investments you may have simply click 'View and Change Assumptions' and follow the prompts.

Log in today and see how you're tracking!

If you have any questions contact us on 1300 033 166 or fill in our online contact form.

Improved navigation

To improve your online experience, the Dashboard now features simplified, image-based navigation across the top of the screen and a new 'quick link' drop-down menu with a prominent Logout button.

And, if you're eligible to make post-tax contributions to your account, your personalised BPAY reference number and our Biller code are now displayed so you can quickly and easily make contributions using your bank’s BPAY facilities.

Log into your new look Dashboard today and check out the new features!

* The estimated retirement balance is currently available to TelstraSuper Corporate Plus and TelstraSuper Personal Plus members with a single account who have been members for more than 12 month and made a contribution during the last 12 months.

†Based on the ASFA Comfortable Lifestyle benchmark income of $1,692 per fortnight for a single person (as at 8/02/2018).