Take control of your super and make your retirement goals a reality

Making the most of your super is easier when you have expert guidance, advice and resources at your fingertips.

Where to start? Search by topic:

Managing your Super Investments Preparing for retirement In retirement Advice Contact us

More webinars and events near you

See what’s coming up and register now.

REGISTER NOW

Managing your super

Whether you're new to super or further down the track, it’s never too early or too late to take control of your super. Once you understand the super basics, the next step is to make the right decisions to support your goals.

The importance of super

It’s one of the biggest assets you’ll ever have. See how super plays an important role in your life while you’re working and in retirement.

Watch here

Investing in super

This webinar covers topics including risk versus return, MySuper and more.

Watch here

Combine your super accounts

Enjoy the benefits of having all your super in one place, with just one set of fees.

Watch here

Is your super "out of sight, out of mind"?

Huy from the Super Sorter team discusses why your super asset can often be forgotten about.

Watch here

Mortgage v Super

Sophie and Kat from the Step It Up advice team discuss putting extra money on your mortgage v in your super.

Watch here

Nominating your beneficiaries

This webinar covers the importance of nominating beneficiaries.

Watch here

What’s your advice for people buying their first home?

Sophie and Kat from the Step It Up advice team discuss the FHSSS and buying your first home.

Watch here

Super Sorter advice in your 20s, 30s and 40s

Huy from the Super Sorter advice team talks about the advice that can help set you up for the future.

Watch Here

What are the most common super questions?

Huy from the Super Sorter team reveals the most commonly asked super questions.

Watch here

Super Conversations - Get Super Savvy Sooner

Women often retire with less super than men but it doesn't have to be that way. Check out this super conversation for ways to become super savvy sooner.

Watch here

Super Conversations - Kick Start Your Super

Super may not seem important or a priority but spending a couple minutes on it can make a big difference to your lifestyle. Check out this super conversation about how to kick start your super.

Watch here

Changing Jobs and Your Super

Learn how to take TelstraSuper to your new employer and avoid multiple super accounts.

Watch here

What advice would our older members give their younger self?

When we asked our members what advice they'd give their younger self a common theme emerged.

Watch here

Navigating Your Redundancy

Discover the ways TelstraSuper can help you navigate your redundancy.

Watch hereTalk to an adviser

Get expert advice from the team you can trust to help make the complex simple. Fees may apply.

BOOK A SUPER HEALTH CHECKInvestments

One of the great benefits of having super is having it invested on your behalf. Whether you want to be more hands on or set and forget, you can tailor your super investments from our suite of investment options whenever your needs change.

Is there a way to prepare my super for market volatility?

Huy from the Super Sorter team discusses how you can prepare your super for market volatility.

Watch here

Our approach to responsible investment

Chief Investment Officer Graeme Miller shares how we consider environmental, social and governance factors in our investments.

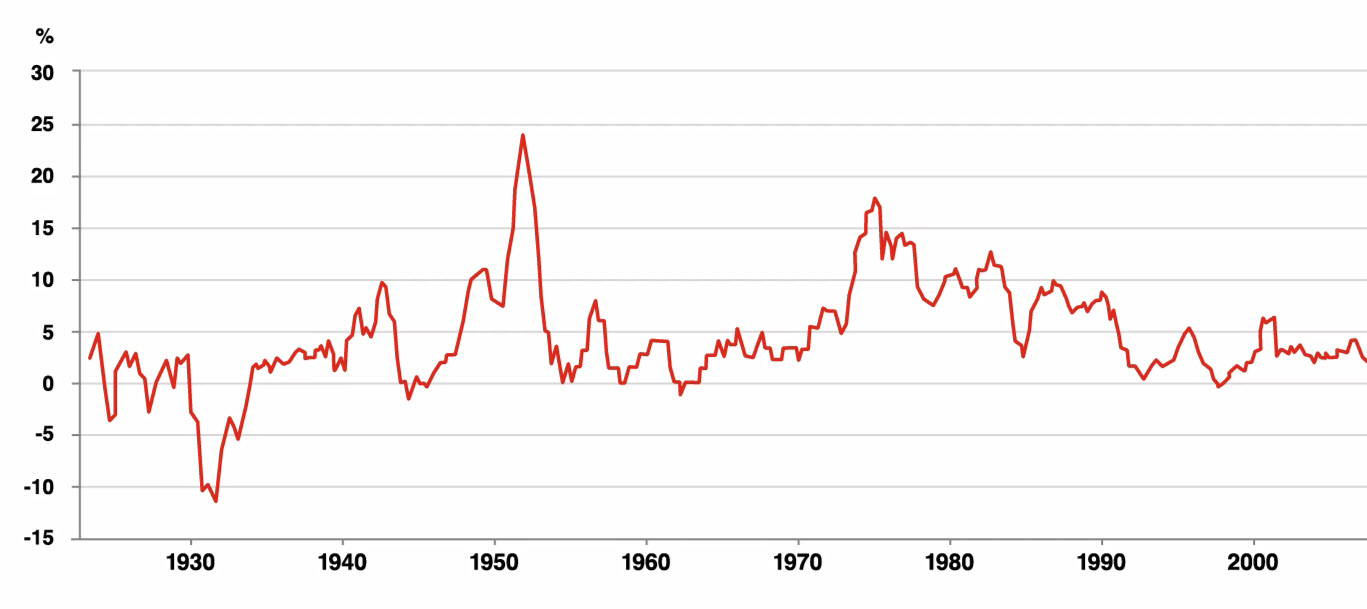

Investment Highlights - Inflation

Discover what inflation is and how it impacts your super.

Watch here

January 2024 Market Update

Global equity markets produced strong returns in January. The value of the Australian Dollar fell against most major foreign currencies, decreasing overseas investment returns when measured in Australian dollar terms. Australian fixed interest markets posted positive returns whilst international fixed interest markets posted negative returns.

Read more

Preparing for retirement

You’ve worked hard to build the life you have. We can help you stay on track to living the retirement of your dreams.

Can I pay myself a salary in retirement?

This can be done easily through opening an Income Stream account like TelstraSuper RetireAccess.

Watch here

Welcome to the Retirement Lifestyle Planner (with tutorial)

A step by step guide through the Retirement Lifestyle Planner.

Watch here

Super Conversations - Paying Yourself An Income In Retirement

Listen to Marg and Bill’s super conversation to discover how you could make your super last in retirement.

Watch here

Funding retirement

This module covers the various income sources available to fund your retirement, how to budget for your retirement and the role the age pension may play.

Start

Retirement basics

This module covers things to think about when planning for retirement such as setting goals, reviewing your financial position and what to do if you’re not on track.

Start

Estate planning

This module covers what your estate is and what’s included, the importance of having a will, what a beneficiary and more.

Start

In retirement

Get help with your finances and managing your income in retirement so you can enjoy the life you’ve worked for.

Getting help with the Age Pension

Catherine Ho from TelstraSuper Financial Planning discusses the Age Pension and how she can help clients.

WATCH HERE

Have you planned for all 3 stages of retirement?

For many people, retirement will span 30 odd years, and their needs and expenses will change throughout.

Watch here

Social Security

This module covers who can qualify for an Age Pension, the Age Pension rates, how the means and asset tests work and how to claim the Age Pension.

Start

Choosing aged care

This module provides general information on what to look for when choosing age care facilities and issues to consider when doing your research and applying to residential care.

Start

Costs of aged care

This module looks at the costs involved with aged care, the government funding available and ways to fund it should you need to make a contribution to your care.

Start

Funding aged care

This module looks at how to fund aged care. It covers topics like paying for home services or residential home care, maintaining adequate case flow and entitlements you may be eligible for.

Start

Advice

Getting financial advice can help you feel more confident and in control of your future. Expert advisers from TelstraSuper Financial Planning can help you set up your super account from starting out, through life’s biggest changes, to planning for retirement.

Why is financial planning important for women?

Catherine Ho from TelstraSuper Financial Planning discusses a great first step women can take to set up their finances for success.

WATCH HERE

Is it ever too late to get financial advice?

Huy from the Super Sorter team reveals if you’ve ever left it too late to benefit from advice.

Watch here

Is it ever too early or too late to get financial advice?

Huy from the Super Sorter team discusses the right time to get advice.

Watch here

How financial planning has helped people achieve a brighter future

Catherine Ho from TelstraSuper Financial Planning talks about how she’s helped clients achieve their retirement dreams.

WATCH HERE

How often can I call for help with my super

Huy from the Super Sorter team talks about how many times you can call with questions on your super.

Watch here

Get expert help with your super

We’re always here to help you with your super, finances, retirement advice and more.