Your investments just got smarter

Four enhanced options.

Purpose-built for retirement.

We understand that investing in retirement is different to investing while you are still working. The priorities are on maximising income and managing volatility. We’ve updated some of the RetireAccess Retirement income stream investments to be designed specifically for members who are drawing an income in retirement. You can view the options in your SuperOnline account.

If you are invested in a retirement income stream the following changes have been made to the investment options available.

The following investments have been renamed to reflect a new strategy, new functionality and to distinguish them from the options available for members who are still working or in a transition to retirement income stream.

Old Name |

New name |

| Growth | Lifestyle Growth |

| Balanced | Lifestyle Balanced |

| Diversified Income | Lifestyle Moderate |

| Conservative | Lifestyle Conservative |

The asset allocations for the Lifestyle investment options have been adjusted to reduce market volatility and risk over the longer term, while achieving a similar total return. The updated asset allocations cater to retiree needs by investing in a revised growth/defensive asset mix, assets with less volatility and assets that provide more stable and higher income yields. Asset allocations for individual investment options can be viewed here, or download the Product Disclosure Statement

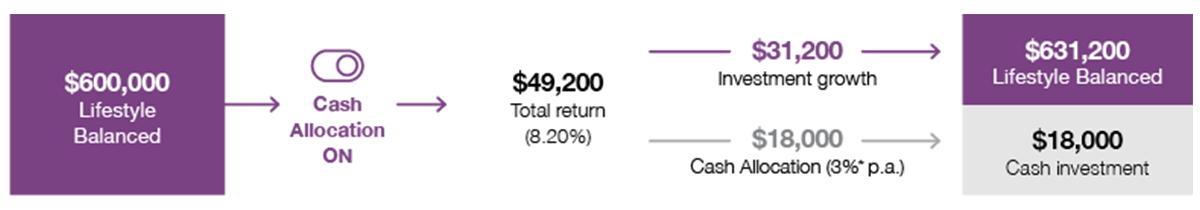

To provide greater investment flexibility, retired members are able to automatically allocate some of their investment to the Cash investment option each month. This feature is available in all Lifestyle investment options

The Cash Allocation feature is optional and, if you turn it on, a declared* rate of return will be determined monthly. This rate is then used to convert some of the growth on your Lifestyle investment option into the Cash investment option on a monthly basis over a 12 month period.

You can make an investment switch into a Lifestyle investment option, turn on the Cash Allocation feature and choose which investment options you want to draw your income from in your SuperOnline account. Simply complete these three steps: