How TelstraSuper compares

Choosing the right super fund could make a big difference in retirement.

Why TelstraSuper? Here are 6 great reasons

Competitive

Fees

We aim to keep our fees as low as possible so more profits can go to you.

Profits back

to you

Fund profits are for you, our members, not shareholders. Isn't that a much smarter way to build wealth for members' retirement?

Strong long-term

performance

Our diversified investments are strong performers over the long-term*, which could mean more money for you in retirement.

Simple advice

on your super

Super can be complex. Speak to our Member Services teams for information that’s easily delivered, at no additional cost^^ to you.

When we win,

you win!

For the past 18 years we’ve been ranked one of the top Australian funds by SuperRatings,** receiving a platinum rating along with a cabinet full of super awards.

Responsible

Investors

We care about your future – we consider material environmental, social and governance factors as part of our investment decision making processes.

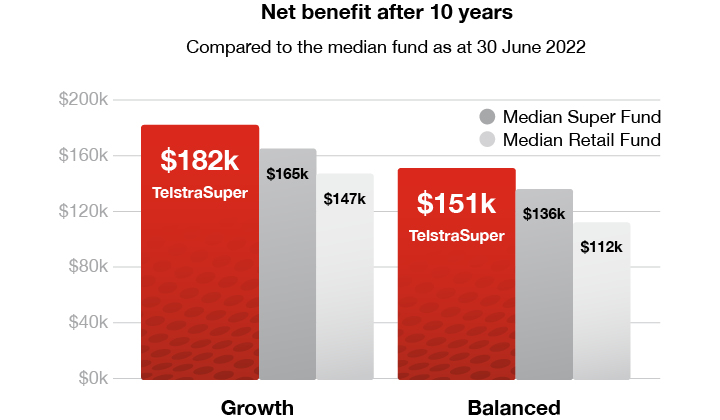

How we stack up over 10 years against the median

Looking at returns and fees separately doesn’t always tell the full story. The net benefit looks at the growth your super is providing in returns and takes out the fees and costs to give you the full picture of how your super is performing.

According to the Net Benefit† modelling by SuperRatings#, if you’d joined TelstraSuper 10 years ago with $100,000 invested in the Growth option and a starting salary of $80,000, you’d be approximately $17,000 better off than the median fund† and approximately $35,000 better off than a median retail super fund†. For the Balanced option you’d be approximately $15,000 better off than the median fund^ and approximately $39,000 better off than a median retail super fund^.

Compare TelstraSuper with AppleCheck

AppleCheck is a simple online tool which allows you to compare super and pension funds on a fair and 'apples with apples' basis. AppleCheck compares our key features with over 200 other funds and has been prepared by specialist superannuation research consultant, Chant West. ‡

Highest ranking

We’re proud that our accumulation and pension products have been awarded Chant West’s highest ranking of 5 Apples for 2021. The ratings are based on extensive criteria and relate to industry best practice. ‡ ‡

Use AppleCheck now

Click on one of the buttons below to compare the right super or pension products for you

Compare TelstraSuper's employer product for current employees of the Telstra Group and Telstra approved employers.

Compare TelstraSuper’s personal product for former employees of the Telstra Group and Telstra approved employers, and their family and friends.

Compare TelstraSuper's retirement income stream product.

Join us

You can be part of a leading profit-to-members super fund and enjoy competitive fees and many other benefits of membership.

Disclaimer and notes

*Based on Monthly SuperRatings Comparison for Balanced, Growth and Conservative investment options over a 10 year period up to 30 June 2021, when compared with the performance of similar types of investment options in other funds surveyed by SuperRatings, which you can only access by registering on the SuperRatings website. For further information about SuperRatings ratings and methodologies visit their website. Any general advice in this document has been prepared without taking into account your objectives, financial situation or needs. Before you act on any general advice in this document, you should consider whether it is appropriate to your individual circumstances. Before making any decisions, you should obtain and read the relevant Product Disclosure Statement. Past performance is no indication of future performance.^^Includes general and simple personal advice about your TelstraSuper account over the phone.

**The rating is issued by SuperRatings Pty Ltd ABN 95 100 192 283 AFSL 311880 (SuperRatings). TelstraSuper has received a Platinum rating from SuperRatings over the past 16 years. Visit www.telstrasuper.com.au/about-us/awards to find out more. † The results compare TelstraSuper’s Balanced option with the median of the balanced options of funds tracked by SuperRatings (253 funds) in respect of the net benefit. The results also compare TelstraSuper’s Balanced option with the median Master Trust Retail super funds tracked by SuperRatings (123 funds) in respect of net benefit that have a comparable balanced option to the TelstraSuper Balanced option. Comparisons are made over a 10 year performance history, taking into account historical earnings and fees – excluding contribution, entry, exit, insurance and additional adviser fees that may have been charged over that period. See full assumptions here. As comparisons are made against the median, outcomes will vary between individual fund comparisons.

‡ ‡ www.chantwest.com.au/fund-ratings/super-methodology

Any general advice on this website has been prepared without taking into account your objectives, financial situation or needs. Before you act on any general advice on this website, you should consider whether it is appropriate to your individual circumstances. Before making any investment decision, you should obtain and read the relevant product disclosure statement which is available on the Website or by calling 1300 033 166 between 8.30 am and 6.00 pm (AEST) Monday to Friday. You may wish to consult an Adviser before you make any decisions relating to your financial affairs. To speak with an Adviser from TelstraSuper Financial Planning call 1300 033 166.