Selling your family home

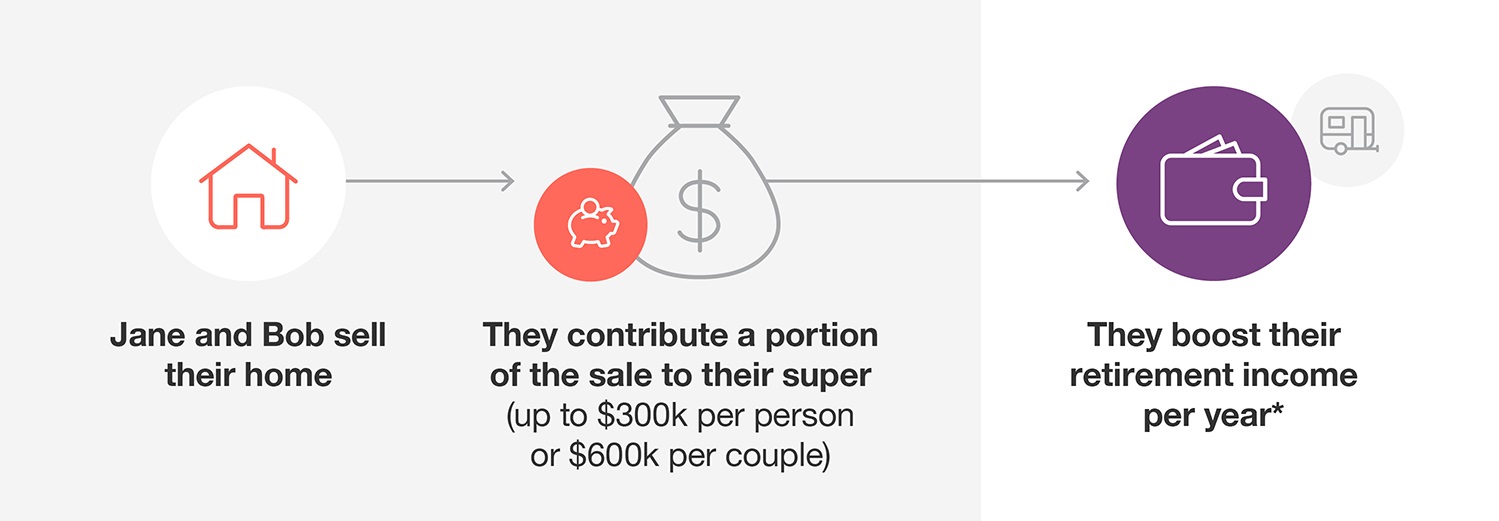

Time to downsize to a smaller home? If you've reached the eligible age, you may be able to contribute the proceeds of downsizing your home into superannuation.

How it works

If you're 55 years old or over and sell your home, you may be eligible to contribute the proceeds into super. You may make contributions up to $300,000 for individuals or $600,000 for couples. Contributions made under the downsizer measure do not count towards existing contributions caps or any restrictions to voluntary contributions.

| Contribute $100k to their super | $9,055 |

| Contribute $200k to their super | $18,111 |

| Contribute $300k to their super | $27,166 |

Assumptions:

- Based on a single retired member, making a 'downsizer contribution' at age 55 and starting to draw income stream from age 60.

- It’s invested in an investment option which achieves a return of CPI + 2.5% p.a. (CPI is assumed to be 2.5% p.a.*)

- Income is shown in future dollars. This example is for illustrative purposes only and is not intended to provide a forecast or guarantee an outcome.

- Downsizer contributions will generate extra income that is estimated be received until the age of 85.

Eligibility

- you must be 55 years old or over.

- the house must be in Australia and cannot be a caravan, houseboat or mobile home.

- you or your spouse must have owned the residence on a continuous basis for more than ten years.

- you have not previously made a downsizer contribution to your super from the sale of another home or from the part sale of your home.

To see a full list of eligibility criteria, visit the Australian Taxation Office (ATO) website.

You may make as many contributions to as many funds as you wish, however the contributions can only ever be made from the proceeds of the sale of one dwelling. The amount you contribute cannot be greater than the caps listed above or the total proceeds of the sale of your home.

Caps

There is no restriction on making non-concessional contributions under the downsizing cap, even if you have over $1.9 million in your total super balance. However, if you have reached your personal transfer balance cap, these contributions must remain in the accumulation phase.

It is important to note that downsizer contributions will count towards your Age Pension assets test.

How to make a downsizer contribution

You must make a choice to treat a contribution as a downsizer contribution before or at the time the contribution is made into your TelstraSuper account. To make a downsizer contribution simply complete the downsizer contribution into super form and return it with your cheque (do not use Bpay). Alternatively, you can complete the ATO form. If you make multiple contributions, you must provide a form for each contribution.

All downsizer contributions must be made within 90 days of receiving the proceeds of sale. You may be eligible to apply to the ATO for an extension of time in some circumstances.

What should you do?

As with any financial decision, you should look at your own personal situation before taking action. TelstraSuper Financial Planning has a team of phone based Advisers who can provide you with simple advice about your TelstraSuper account. You can contact them on 1300 033 166 or fill in the online contact form. There's no additional cost for our phone based advice as this is included in your TelstraSuper membership.

*Assumptions made on 1 May 2023.