The Product Dashboard below is legislatively mandated and is designed to provide members with a snapshot of investment performance, risk, and fees and costs associated with TelstraSuper's MySuper Lifecycle. The Product Dashboard is based on our understanding of the calculations and other requirements prescribed by the law (including regulatory standards) applicable to a product dashboard.

Please note:

- The return target is an estimate of the expected return above inflation over a ten year period for the investment option after taxes, fees and costs. Return targets have been calculated in accordance with applicable legislation for a member with a $50,000 balance. Return Targets differ from the return objectives set by the Trustee and set out in TelstraSuper’s Investment Guide. As the return target is a prediction only, there is no guarantee that the return target will be actually achieved or exceeded in any period.

- Returns for MySuper Growth, MySuper Balanced, MySuper Moderate and MySuper Conservative take into account the historical investment history of the Growth, Balanced, Moderate and Conservative investment options offered by TelstraSuper as default investment strategies prior to the commencement of TelstraSuper's MySuper arrangement, subject to prescribed or allowable adjustments.

- The investment returns displayed in the Product Dashboard are based on returns (net of applicable fees and costs) during the periods shown and reflect (as required) the highest fee levels (where TelstraSuper has had multiple fee levels in the past).

- The statement of fees and costs is for one year based on fees and costs applicable to accumulation members in the MySuper arrangement (assuming a $50,000 account balance). It does not reflect all fees and costs that may apply (for example, activity fees and insurance fees aren’t included).

- The returns displayed in the Product Dashboard are not the same or equivalent to investment returns reported elsewhere by TelstraSuper and may not equate to the investments returns allocated to your account during the periods shown. The allocation of investment returns to your account depends on a range of factors including when money moves into and out of your account.

Past performance is not a reliable indicator of future performance. The information in the Product Dashboard may change from time to time.

For further information about TelstraSuper's MySuper Lifecycle, refer to the TelstraSuper Personal Plus Product Disclosure Statement and TelstraSuper Corporate Plus Product Disclosure Statement.

Investment or other decisions relating to your TelstraSuper account should be made having regard to the relevant product disclosure statement.

TelstraSuper MySuper investment stages

-

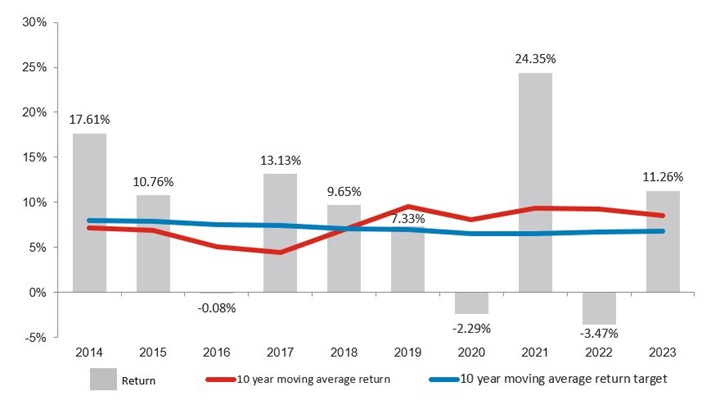

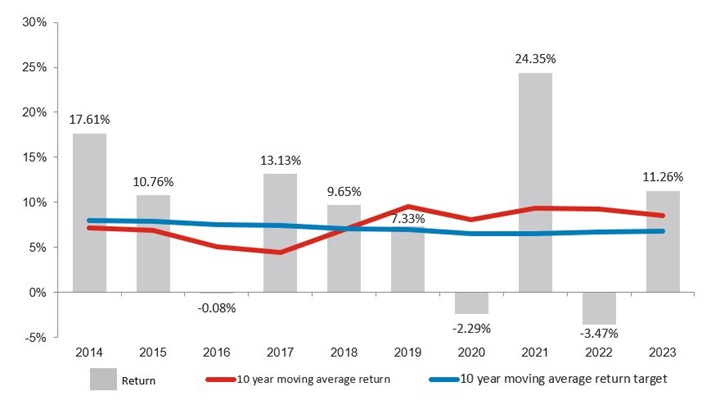

MySuper Growth Product Dashboard

Return target

Return target for 2024-2033 of 3.28% per year above inflation, after fees and taxes.

Future returns cannot be guaranteed. This is a prediction only.

Return

| Year to |

Return (%) |

| 30/06/2023 |

11.26% |

| 30/06/2022 |

-3.47% |

| 30/06/2021 |

24.35% |

| 30/06/2020 |

-2.29% |

| 30/06/2019 |

7.33% |

| 30/06/2018 |

9.65% |

| 30/06/2017 |

13.13% |

| 30/06/2016 |

-0.08% |

| 30/06/2015 |

10.76% |

| 30/06/2014 |

17.61% |

Comparison between return target and return

Level of investment risk

High

Estimated number of negative net investment returns over a 20 year period is 4 to less than 6

Statement of fees and other costs

$562

Portfolio holdings disclosure

TelstraSuper is proud of our investment track record and approach to responsible investment. To provide a better understanding of what that means and how we invest our funds on behalf of our members, every 30 June and 31 December reporting date we take a “snapshot” of our portfolio holdings‡ and then break it down to show the investment allocations for each investment option. In line with current legislation, this information is made available within 90 days of each reporting date and is presented to meet the required reporting and formatting standards. For more information please see the Investments - Portfolio Holdings Disclosure section of our FAQs page.

VIEW THE DISCLOSURE FOR THE MYSUPER GROWTH OPTION

‡ The portfolio holdings information disclosed is current only on the applicable 30 June or 31 December reporting date in a particular year. Portfolio holdings information is only updated twice a year on a date that is within 90 days after a reporting date. The portfolio holdings disclosures are made for informational purposes only and do not constitute any recommendation and/or endorsement to any person to buy or sell any investment or employ and/or implement any particular investment strategy. Any general advice on this website document has been prepared without taking into account your objectives, financial situation or needs. Before you act on any general advice in this document, you should consider whether it is appropriate to your individual circumstances. Before making any investment decision, you should obtain and read the relevant product disclosure statement. You may wish to consult a financial adviser before you make any decisions relating to your financial affairs. Past performance is no indicator of future returns.

-

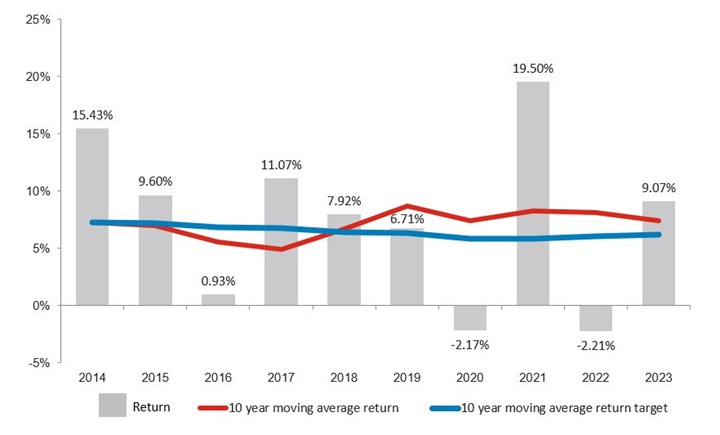

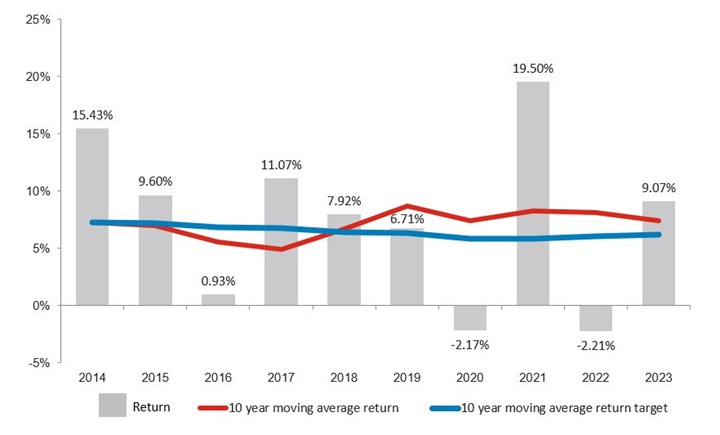

MySuper Balanced Product Dashboard

Return target

Return target for 2024-2033 of 2.92% per year above inflation, after fees and taxes.

Future returns cannot be guaranteed. This is a prediction only.

Return

| Year to |

Return (%) |

| 30/06/2023 |

9.07% |

| 30/06/2022 |

-2.21% |

| 30/06/2021 |

19.50% |

| 30/06/2020 |

-2.17% |

| 30/06/2019 |

6.71% |

| 30/06/2018 |

7.92% |

| 30/06/2017 |

11.07% |

| 30/06/2016 |

0.93% |

| 30/06/2015 |

9.60% |

| 30/06/2014 |

15.43% |

Comparison between return target and return

Level of investment risk

High

Estimated number of negative net investment returns over a 20 year period is 4 to less than 6

Statement of fees and other costs

$542

Portfolio holdings disclosure

TelstraSuper is proud of our investment track record and approach to responsible investment. To provide a better understanding of what that means and how we invest our funds on behalf of our members, every 30 June and 31 December reporting date we take a “snapshot” of our portfolio holdings‡ and then break it down to show the investment allocations for each investment option. In line with current legislation, this information is made available within 90 days of each reporting date and is presented to meet the required reporting and formatting standards. For more information please see the Investments - Portfolio Holdings Disclosure section of our FAQs page.

VIEW THE DISCLOSURE FOR THE MYSUPER BALANCED OPTION

‡ The portfolio holdings information disclosed is current only on the applicable 30 June or 31 December reporting date in a particular year. Portfolio holdings information is only updated twice a year on a date that is within 90 days after a reporting date. The portfolio holdings disclosures are made for informational purposes only and do not constitute any recommendation and/or endorsement to any person to buy or sell any investment or employ and/or implement any particular investment strategy. Any general advice on this website document has been prepared without taking into account your objectives, financial situation or needs. Before you act on any general advice in this document, you should consider whether it is appropriate to your individual circumstances. Before making any investment decision, you should obtain and read the relevant product disclosure statement. You may wish to consult a financial adviser before you make any decisions relating to your financial affairs. Past performance is no indicator of future returns.

-

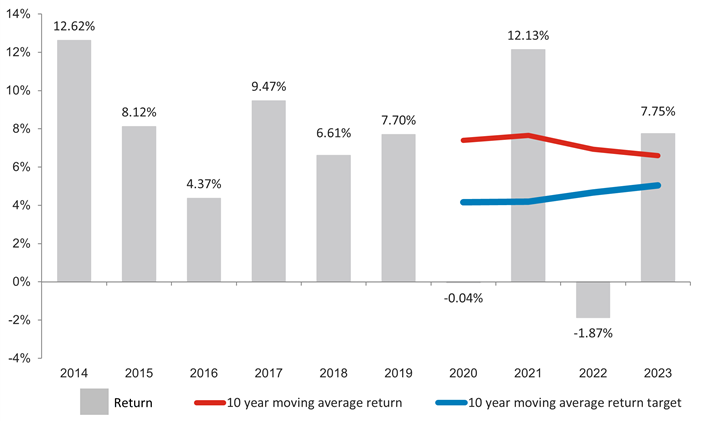

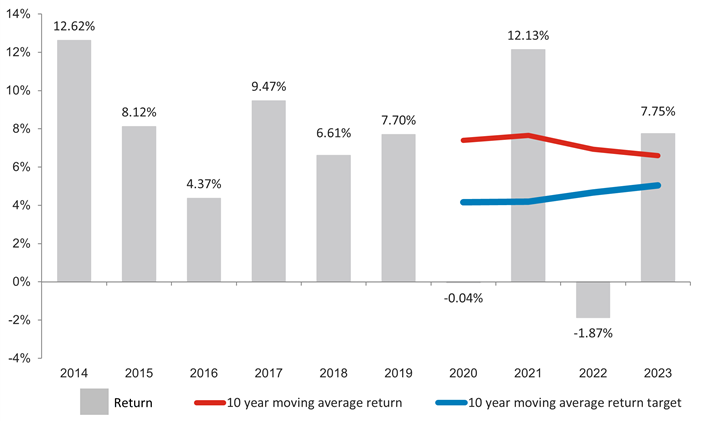

MySuper Moderate Product Dashboard

Return target

Return target for 2024-2033 of 2.38% per year above inflation, after fees and taxes.

Future returns cannot be guaranteed. This is a prediction only.

Return

| Year to |

Return (%) |

| 30/06/2023 |

7.75% |

| 30/06/2022 |

-1.87% |

| 30/06/2021 |

12.13% |

| 30/06/2020 |

-0.04% |

| 30/06/2019 |

7.70% |

| 30/06/2018 |

6.61% |

| 30/06/2017 |

9.47% |

| 30/06/2016 |

4.37% |

| 30/06/2015 |

8.12% |

| 30/06/2014 |

12.62% |

MySuper Moderate was introduced on 1 October 2023 and its predecessor the Moderate option was introduced on 1 July 2023 and the Moderate option predecessor Defensive Growth was introduced on 1 July 2010. As such, any historic returns prior to 1 October 2023 will reflect that of the relevant predecessor.

Comparison between return target and return

Please note that the MySuper Moderate predecessor product, Defensive Growth, was introduced on 1 July 2010. As such, the 10 year moving average return exists from 1 July 2020 onwards.

Level of investment risk

Medium to High

Estimated number of negative net investment returns over a 20 years period is 3 to less than 4.

Statement of fees and other costs

$462

Portfolio holdings disclosure

TelstraSuper is proud of our investment track record and approach to responsible investment. To provide a better understanding of what that means and how we invest our funds on behalf of our members, every 30 June and 31 December reporting date we take a “snapshot” of our portfolio holdings‡ and then break it down to show the investment allocations for each investment option. In line with current legislation, this information is made available within 90 days of each reporting date and is presented to meet the required reporting and formatting standards. For more information please see the Investments - Portfolio Holdings Disclosure section of our FAQs page.

VIEW THE DISCLOSURE FOR THE MYSUPER MODERATE OPTION

‡ The portfolio holdings information disclosed is current only on the applicable 30 June or 31 December reporting date in a particular year. Portfolio holdings information is only updated twice a year on a date that is within 90 days after a reporting date. The portfolio holdings disclosures are made for informational purposes only and do not constitute any recommendation and/or endorsement to any person to buy or sell any investment or employ and/or implement any particular investment strategy. Any general advice on this website document has been prepared without taking into account your objectives, financial situation or needs. Before you act on any general advice in this document, you should consider whether it is appropriate to your individual circumstances. Before making any investment decision, you should obtain and read the relevant product disclosure statement. You may wish to consult a financial adviser before you make any decisions relating to your financial affairs. Past performance is no indicator of future returns.

-

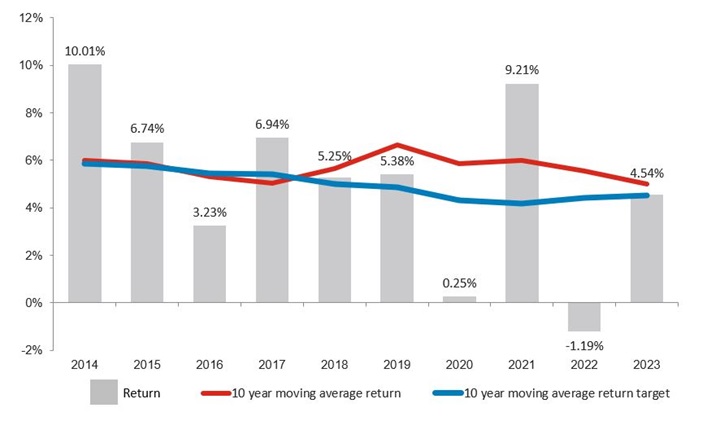

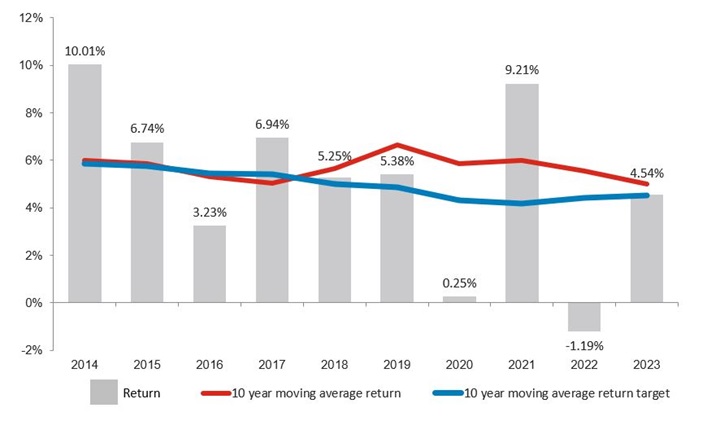

MySuper Conservative Product Dashboard

Return target

Return target for 2024-2033 of 1.74% per year above inflation, after fees and taxes.

Future returns cannot be guaranteed. This is a prediction only.

Return

| Year to |

Return (%) |

| 30/06/2023 |

4.54% |

| 30/06/2022 |

-1.19% |

| 30/06/2021 |

9.21% |

| 30/06/2020 |

0.25% |

| 30/06/2019 |

5.38% |

| 30/06/2018 |

5.25% |

| 30/06/2017 |

6.94% |

| 30/06/2016 |

3.23% |

| 30/06/2015 |

6.74% |

| 30/06/2014 |

10.01% |

Comparison between return target and return

Level of investment risk

Low to medium

Estimated number of negative net investment returns over a 20 year period is 1 to less than 2

Statement of fees and other costs

$427

Portfolio holdings disclosure

TelstraSuper is proud of our investment track record and approach to responsible investment. To provide a better understanding of what that means and how we invest our funds on behalf of our members, every 30 June and 31 December reporting date we take a “snapshot” of our portfolio holdings‡ and then break it down to show the investment allocations for each investment option. In line with current legislation, this information is made available within 90 days of each reporting date and is presented to meet the required reporting and formatting standards. For more information please see the Investments - Portfolio Holdings Disclosure section of our FAQs page.

VIEW THE DISCLOSURE FOR THE MYSUPER CONSERVATIVE OPTION

‡ The portfolio holdings information disclosed is current only on the applicable 30 June or 31 December reporting date in a particular year. Portfolio holdings information is only updated twice a year on a date that is within 90 days after a reporting date. The portfolio holdings disclosures are made for informational purposes only and do not constitute any recommendation and/or endorsement to any person to buy or sell any investment or employ and/or implement any particular investment strategy. Any general advice on this website document has been prepared without taking into account your objectives, financial situation or needs. Before you act on any general advice in this document, you should consider whether it is appropriate to your individual circumstances. Before making any investment decision, you should obtain and read the relevant product disclosure statement. You may wish to consult a financial adviser before you make any decisions relating to your financial affairs. Past performance is no indicator of future returns.