Make the most of your Defined Benefit – Division 2 members

Defined benefit super can be complex. To make it easier, we’ve put together the questions you might ask and provided the answers to help you understand your defined benefit and make the most of your super.

This information applies to members of TelstraSuper Division 2. If you’re a member of TelstraSuper Division 5, refer to your Super Guide for more information or contact us with your questions.

Find out about the benefits and services to you as a Defined Benefit member.

Frequently Asked Questions

- How is my super salary determined?

- How does my salary package fund my defined benefit?

- Can I reduce the amount going into my super from my employer so I can receive more cash salary?

- How is my Final Average Salary (FAS) calculated?

- How much should I contribute to my defined benefit?

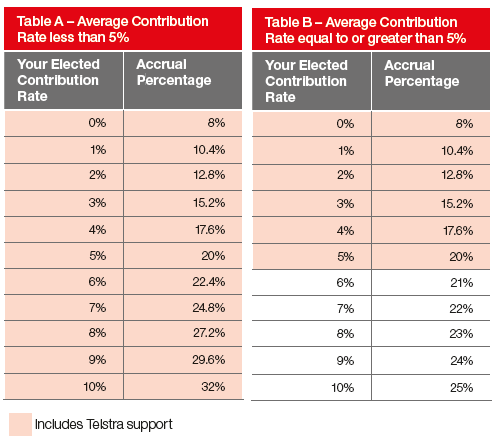

- How do I calculate my average contribution rate?

- How is my benefit multiple calculated?

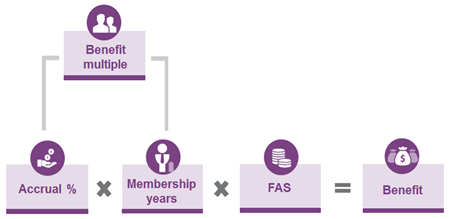

- What is the defined benefit formula?

- Should I stay in DB or would I be best to change to an accumulation account?

- My salary has plateaued and I don’t expect much growth from now until I retire in about 10 years. How will this affect my defined benefit?

- I’ve checked how much I’m likely to retire with and I’d like to contribute more while I’m still working. What are my options?

- How do I calculate the defined benefit concessional contributions which count towards my concessional contributions cap?

- What happens to my defined benefit if I go part-time?

- I’m planning to take some leave without pay in the next year. How will this impact my defined benefit?

- What happens to my defined benefit if I go on Long Service Leave?

- What happens if go on Long Service Leave at half pay?

- The superannuation salary that TelstraSuper has is incorrect, what do I do?

- Can I access my DB under compassionate grounds?

- Can my TelstraSuper Division 2 Defined Benefit go backwards/ drop in value?

- How is my defined benefit impacted if I move to a role with a lower salary?

- When can I access the Restricted Non Preserved amount detailed on my DB statement?

- Can I access my TelstraSuper Division 2 Defined Benefit when I turn 65?

- I’m thinking about retiring in a few years. Is there anything I should know about choosing the best time to make the most of my super?

- I’m expecting a good salary increase in the next few months. How will this impact my super?

- What insurance do I have in my defined benefit?

- What happens to my defined benefit if I leave Telstra?

How we can help

You can learn more about your defined benefit super by:

- Attending a seminar

- Speaking to TelstraSuper Financial Planning for advice on strategies

- Reading the TelstraSuper Division 2 Super Guide

- Talking to us – if you have any questions call us on 1300 033 166