With all the market volatility is my super still on target?

August 18, 2022

Investment markets have had a bumpy ride lately and you would have noticed the effect on your super balance. But does this volatility mean your super isn’t performing as expected? And is your investment option still meeting its long-term objectives?

The important thing to remember about super is that it will most likely be invested for many years to come. This longevity means that it should have time to ride out market volatility, and over time build a nest egg for your future.

How do you know if your super is on target?

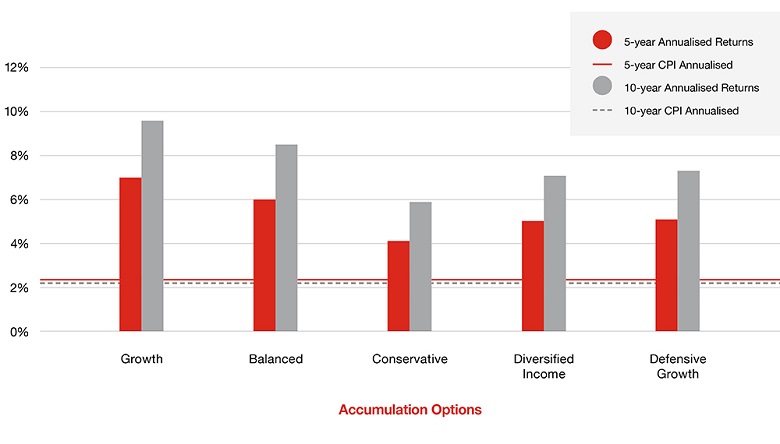

We can’t see into the future so when a diversified investment option, such as a balanced, conservative or growth option, is developed, we factor in both market highs and lows to set the return objective. The return objective is generally communicated as exceeding CPI inflation by a margin over a specified period. For example, TelstraSuper’s Balanced investment option is set to outperform the CPI by 3% over 5-10 years.

We are pleased to report that all our diversified investment options have met their return objectives over 5 and 10 years, with the returns comfortably above CPI inflation in the same time periods. This is outlined in the chart below.

The Balanced and Conservative investment options were both SuperRatings top 10 performers for the year ending 30 June 2022.

It is worth noting however that the combination of increasing interest rates and rising inflation coupled with the expectation of lower returns means the ability to meet these return objectives could be impacted over the short to medium-term. In other words, we think that it will be more difficult, but certainly not impossible, to achieve these return objectives in the medium term, given current market conditions.

We want to assure members that we have a team of investment professionals that actively manage your super savings and will continue to look for opportunities in the current markets to maximise the likelihood of achieving our performance objectives.

Are volatile markets here to stay?

Get help with your investments