How does it work?

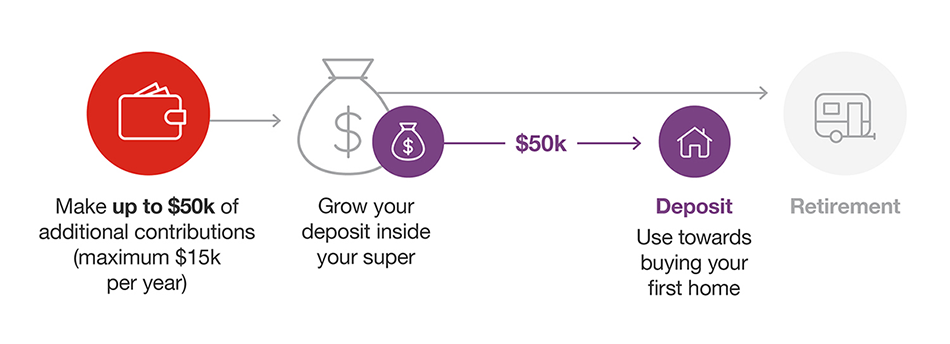

If you’re an eligible first home buyer, the First Home Super Saver (FHSS) scheme allows you a one-off opportunity to withdraw some of your voluntary super contributions to put towards a first home deposit.

You can save money for your first home within your super account, where tax concessions and the rate of interest can boost your savings.

Your super contributions for the FHSS scheme can be either voluntary concessional (pre-tax) or voluntary non-concessional (post-tax) contributions.

Who is eligible?

To be eligible to withdraw voluntary contributions under the FHSS scheme, you must:

- be 18 years or older;

- have not previously held interest in property (subject to certain exceptions); and

- have not previously accessed the FHSS scheme.

To see a full list of eligibility criteria, visit the ATO website.

Is the FHSS scheme right for you?

Our team of super experts at TelstraSuper Financial Planning can talk you through the details of the FHSS scheme and whether this could help you boost your first home deposit. Call 1300 033 166 or request a call back.

LET'S CHAT

How much can you use for a deposit?

The scheme allows you to use up to $15,000 of your voluntary contributions from any financial year included in your eligible contributions, up to a total of $50,000 across all years.

Any super that your employer is obliged to pay or spouse contributions can’t be used – only the extra voluntary contributions you’ve made since 1 July 2017.

How much will you get?

To start saving for your deposit, all you have to do is make additional contributions (for example by making a salary sacrifice before-tax contribution) into your super each year, within the annual contribution limits. See the table below for more details.

| Before tax contribution limits | Maximum per year you can use for your deposit | Total amount you can save for your house deposit | |

| 2024/25 | $30,000 | $15,000 | Up to $50,000 |

Check your balance with TelstraSuper at any time to see how much you have saved.

When you are ready to receive your FHSS amounts, you need to apply to the Australian Taxation Office (ATO) for an FHSS determination and a release. After applying, the ATO will tell you your maximum FHSS release amount and the ATO will withhold tax from the FHSS release amount before paying it to you.

Get expert advice about the FHSS scheme

Buying your first home can be overwhelming and complex. Our team of expert advisers from TelstraSuper Financial Planning can discuss the details of the scheme with you and help you make an informed decision. Call 1300 033 166 or request a call back.