This information is general advice only and does not take into account your individual objectives, financial situation or needs. Before acting on any advice you should assess whether it is appropriate for you and consider talking to a financial adviser. Before making any decision or acquiring any product you should obtain and review its Product Disclosure Statement or by calling 1300 033 166.

Account and updates

- Can I change my investment option?

- How do I find how much super I have with TelstraSuper?

- How do I update my beneficiaries?

- I have ceased employment with my TelstraSuper Corporate Plus employer, can I stay with TelstraSuper?

- How can I obtain a copy of a past statement now I’ve left the fund and no longer have access to SuperOnline?

Contributions

- Can I roll over other super money into my TelstraSuper account?

- How do I get my new employer to pay my super into my TelstraSuper account?

- How do I make contributions to my super?

- How does TelstraSuper treat unallocated contributions?

- Is there a limit on the amount that can be contributed?

- What BPAY details do I need to contribute to my own account?

- What BPAY details do I need to contribute to my partner's account?

- What is the best way to contribute to my super: pre-tax or post-tax?

Defined Benefit

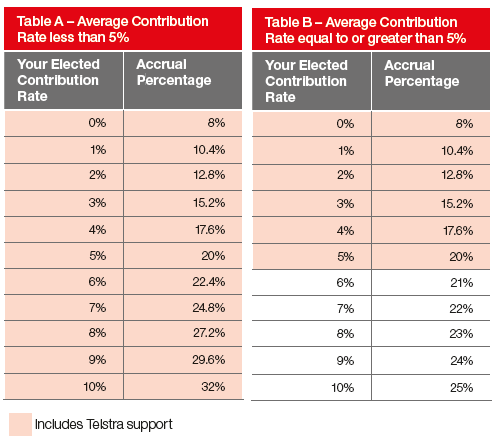

- What is the defined benefit formula?

- How much should I contribute to my defined benefit?

- Should I stay in DB or would I be best to change to an accumulation account?

- Can I reduce the amount going into my super from my employer so I can receive more cash salary?

- What happens to my defined benefit if I leave Telstra?

Investments - Portfolio Holdings Disclosure

- Why are there Fixed Interest securities held in the Cash investment option?

- I know that TelstraSuper excludes investments in thermal coal companies from its investment portfolios where revenue derived from thermal coal exceeds a certain threshold. However I noticed some small investments in thermal coal companies in my Direct Access investment option. Why is this so?

- Understanding the Portfolio Holding Disclosure file

- Is there a charge for changing my investment option?

- What is a buy-sell spread (or cost)?

- Why is there a buy-sell fee for the Property option?