Spouse contribution splitting

The government’s rules around the splitting of contributions allow spouses a one-off, pre-tax split of their super contributions between their accounts.

Contributions splitting enables you to share your super with your spouse* now, as you save, rather than waiting until you are about to retire.

How does it work?

Eligible contributions made to an accumulation account can be split with your spouse, with the transfer of funds made annually after the end of the financial year in which the contributions were made.

Splits can be made to a spouse’s account within the same super fund (such as a TelstraSuper Personal Plus account), or to another super fund or retirement savings account you nominate.

Amounts split to a spouse’s account are preserved on entry to the receiving account.

You can only apply to split contributions made in the current financial year if you are exiting the fund or rolling over your entire benefit to another fund.

Splitable contributions always count towards the contributor’s concessional contribution limits, not the spouse’s limits even though they are receiving the contributions.

Example

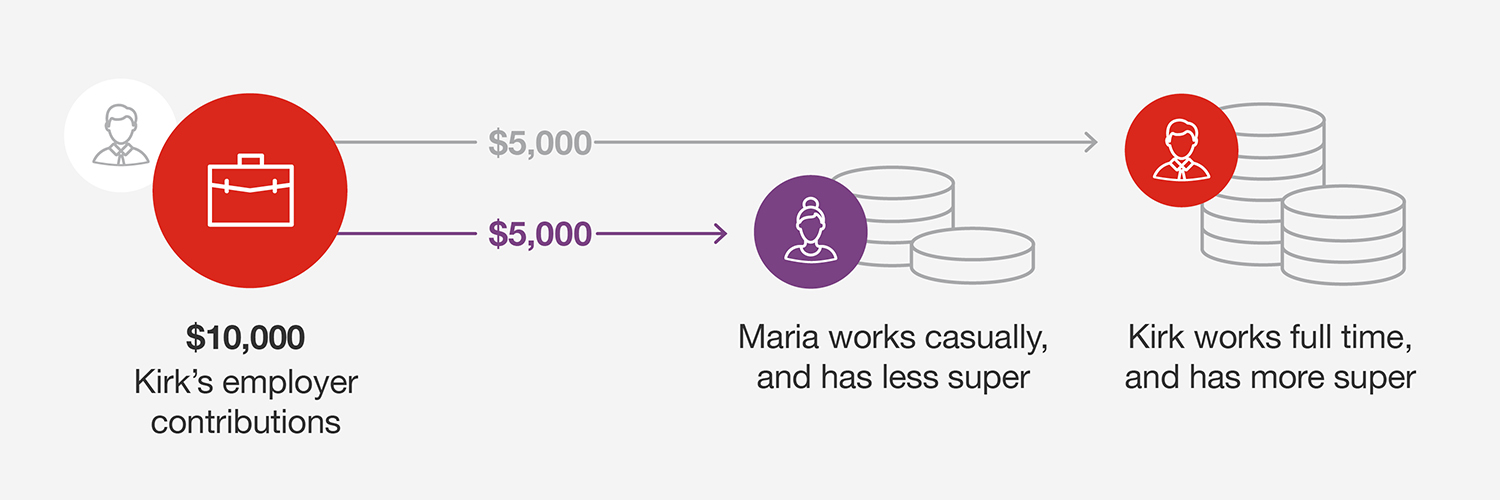

Kirk, 55 works full time and had $10,000 contributed to his super by his employer this financial year. Kirk’s wife Maria, 52 works casually, and he wants to boost her super balance by doing a one-off split of his employer contributions into her account. Kirk calls TelstraSuper who confirms he’s eligible to make the split after 1 July in the new financial year.

In July, Kirk completes the ATO’s Superannuation contributions splitting application form and lodges it with us. He indicates that he’d like to split $5,000 of his employer contributions into Maria’s account.

Kirk’s application is approved because $5,000 is less than 85% of the total $10,000 contributed by his employer and concessional contributions cap. TelstraSuper transfers $5,000 to Maria’s super fund in September (it may take up to 90 days from application).

Who can split contributions?

You are eligible to split contributions with your spouse, on the condition that you and your spouse are living together. To be eligible for contributions splitting, your spouse must be under 65 years of age, even if they are still working. If your spouse is over their preservation age, they must declare they have not retired in order to receive contributions from your account.

Spouse accounts

If your spouse does not work for Telstra they are still welcome to join TelstraSuper. For more information on the Personal Plus membership please read the TelstraSuper Personal Plus Product Disclosure Statement.

Which super contributions can be split?

You and your spouse can choose to split employer Superannuation Guarantee (SG) contributions and pre-tax (salary sacrifice) contributions. You can split any amount less the 15% contributions tax payable, so effectively you can split up to 85% of these gross contributions.

Which super contributions cannot be split?

The following types of contributions cannot be split between spouses:

- Employment Termination Payments (ETPs)

- Post-tax contributions

- Amounts that have been rolled over, transferred or allocated from a previous fund

- Lump sum payments such as those from an overseas fund

- Contributions made prior to 1 January 2006

Contributions splitting can only be applied to accumulation super arrangements. If you are a member of a defined benefit arrangement and have a Voluntary Accumulation Account (VAA), contributions splitting can be applied to your VAA only. If your benefit is subject to a family law split, you cannot apply for contributions splitting.

How do I arrange to split contributions?

You can request contributions to be split once each year after 30 June. For example, to request a split for contributions relating to the current financial year, requests can be made from 1 July the following financial year.

To arrange a split to your spouse’s account, you will need to complete a Contributions Splitting application form.

Once we receive your completed form, your contributions split request will be actioned within 90 days and you will receive a letter confirming your contributions transfer. If your spouse wishes to split their contributions from another super fund into your TelstraSuper account, your spouse will need to arrange this through their super fund.

Another option for both of you: Spouse contributions (after-tax)

If it’s more advantageous for you to make an after-tax contribution to your spouse’s super account, you can make spouse contributions from your own money. This strategy could see you pay less tax while boosting your spouse’s balance.

Need help boosting your super?

At TelstraSuper we’re here to help you build a secure financial future. TelstraSuper Financial Planning has a team of phone based Advisers who can provide you with simple advice to help you get your super on track. If you’d like to discuss growing your super or if you have any other financial advice queries contact us on 1300 033 166 or fill in our online contact form. There's no additional cost for our phone based advice as this is included in your TelstraSuper membership.

*An eligible spouse must be someone you are presently in a relationship with and with whom you live on a genuine domestic basis as a couple. Other conditions apply. For the purposes of contributions splitting, your spouse must be under 65 years of age, even if they are still working. If your spouse is over their preservation age, they must declare they have not retired in order to receive contributions from your account.

This product has a Target Market Determination (TMD) that outlines its target market, distribution conditions and reporting obligations. You can view the TMD here

Any general advice has been prepared without taking into account your objectives, financial situation or needs. Before you act on any general advice, you should consider whether it is appropriate to your individual circumstances. Before making any decision, you should obtain and read the relevant Product Disclosure Statement and Target Market Determination. You may wish to consult an adviser before you make any decisions relating to your financial affairs. To speak with an Adviser from TelstraSuper Financial Planning call 1300 033 166.