Cash

Objective

To build an investment portfolio to achieve the stated return objective within the stated risk parameters over the specified timeframe.

Who should invest?

Those who require access to Cash in the short term or who are seeking a secure, very low risk investment. Over long term periods, Cash is expected to be the lowest returning asset class.

Investment strategy

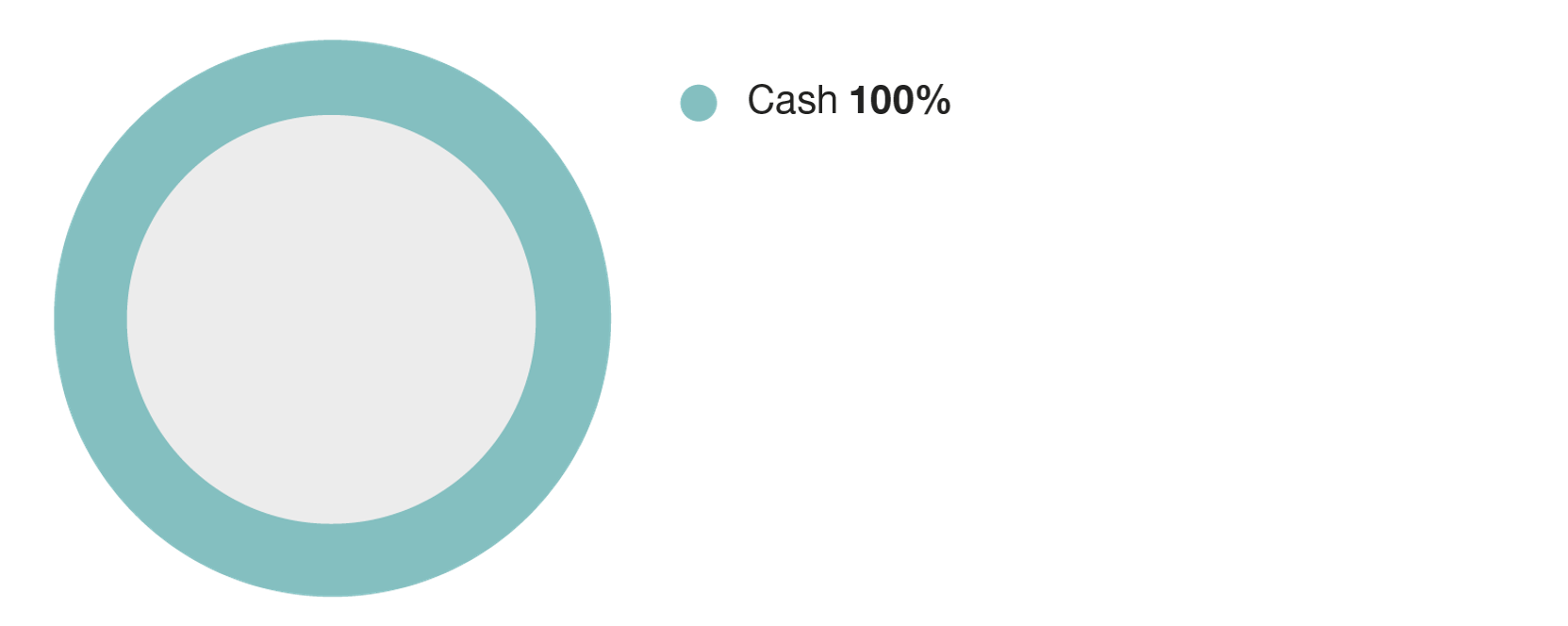

100% invested in cash and short term money market securities.

Return objective

- Corporate Plus, Personal Plus and TTR income stream members: outperform the Bloomberg AusBond Bank Bill Index, adjusted for tax^

- Retirement income stream members: outperform the Bloomberg AusBond Bank Bill Index^

For the purpose of setting and measuring the return objective, a time horizon of 2 years has been used.

Investment timeframe

The recommended investment timeframe for this option is 2 years. Members should consider investing in this option for at least a 0 to 2 year time-horizon. This timeframe provides an indication of the typical length of time over which investments in this option should be expected to be held.

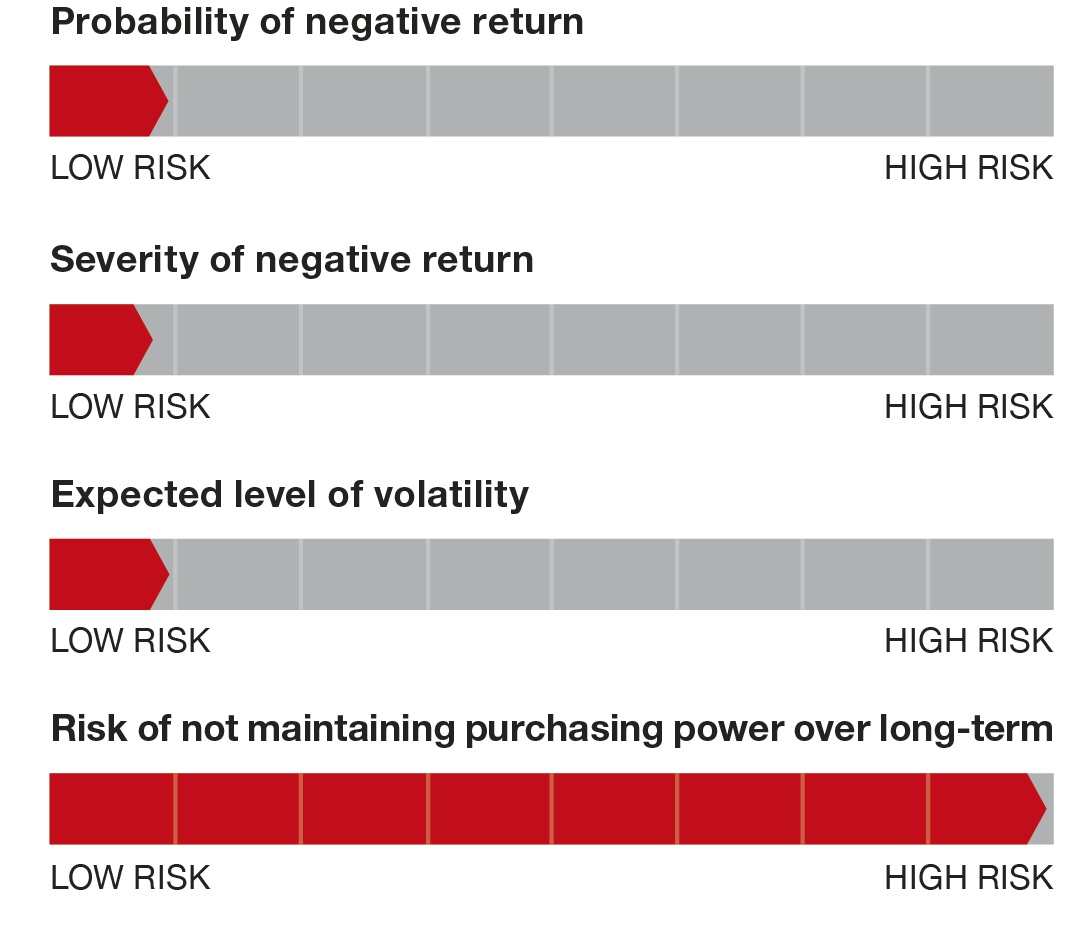

Risk characteristics

The Cash option is TelstraSuper’s most defensive investment option, with the lowest expected level of return and short-term investment risk. This option’s risk characteristics using TelstraSuper’s four measures of investment risk are summarised in the diagrams below:

The Cash option’s Standard Risk Measure* is for a “very low” level of risk expected to generate less than 0.5 negative annual returns over any 20 year period.

Long-term strategic investment mix

100% defensive assets

Cash option investment mix and asset ranges

The aim of this information is to provide members with investment objective and strategy details (including investment mix) that we consider members reasonably need to understand the fund's investments and reflect the manner in which objectives and strategies have been formulated by the Trustee pursuant to superannuation law and discretionary powers under the Trust Deed.

^ The Bloomberg AusBond Bank Bill Index is a commonly used benchmark for cash-like investments. It measures the return earned on a diversified portfolio of different types of short term cash investments. Cash investments are generally taxed at 15% in the superannuation accumulation phase.

* The Standard Risk Measure is a standardised way of communicating investment risk that has been developed by the Association of Superannuation Funds of Australia (ASFA) and the Financial Services Council (FSC)

Cash option returns†

| Accumulation returns | TelstraSuper RetireAccess returns | |

| 2022/2023 | 2.73% | 3.21% |

| 2021/2022 | 0.14% | 0.16% |

| 2020/2021 | 0.43% | 0.48% |

| 2019/2020 | 1.03% | 1.20% |

| 2018/2019 | 1.96% | 2.30% |

| 2017/2018 | 1.74% | 2.01% |

| 2016/2017 | 1.92% | 2.21% |

| 2015/2016 | 2.10% | 2.40% |

| 2014/2015 | 2.47% | 2.79% |

| 2013/2014 | 2.61% | 3.01% |

| 2012/2013 | 3.18% | 3.70% |

| 2011/2012 | 4.14% | 4.84% |

| 5 year returns | 1.75% | 2.03% |

† Past performance is not a reliable indicator of future performance. The accumulation investment returns are net of investment fees and investment taxes, but before deducting any administration fee or indirect administration cost. The TelstraSuper RetireAccess investment returns are net of investment fees but before deducting any administration fee or indirect administration cost.

Portfolio holdings disclosure

TelstraSuper is proud of our investment track record and approach to responsible investment. To provide a better understanding of what that means and how we invest our funds on behalf of our members, every 30 June and 31 December reporting date we take a “snapshot” of our portfolio holdings‡ and then break it down to show the investment allocations for each investment option. In line with current legislation, this information is made available within 90 days of each reporting date and is presented to meet the required reporting and formatting standards. For more information please see the Investments - Portfolio Holdings Disclosure section of our FAQs page.

‡ The portfolio holdings information disclosed is current only on the applicable 30 June or 31 December reporting date in a particular year. Portfolio holdings information is only updated twice a year on a date that is within 90 days after a reporting date. The portfolio holdings disclosures are made for informational purposes only and do not constitute any recommendation and/or endorsement to any person to buy or sell any investment or employ and/or implement any particular investment strategy. Any general advice on this website document has been prepared without taking into account your objectives, financial situation or needs. Before you act on any general advice in this document, you should consider whether it is appropriate to your individual circumstances. Before making any investment decision, you should obtain and read the relevant product disclosure statement. You may wish to consult a financial adviser before you make any decisions relating to your financial affairs. Past performance is no indicator of future returns.