Seamless transfer

Direct Access investments to RetireAccess

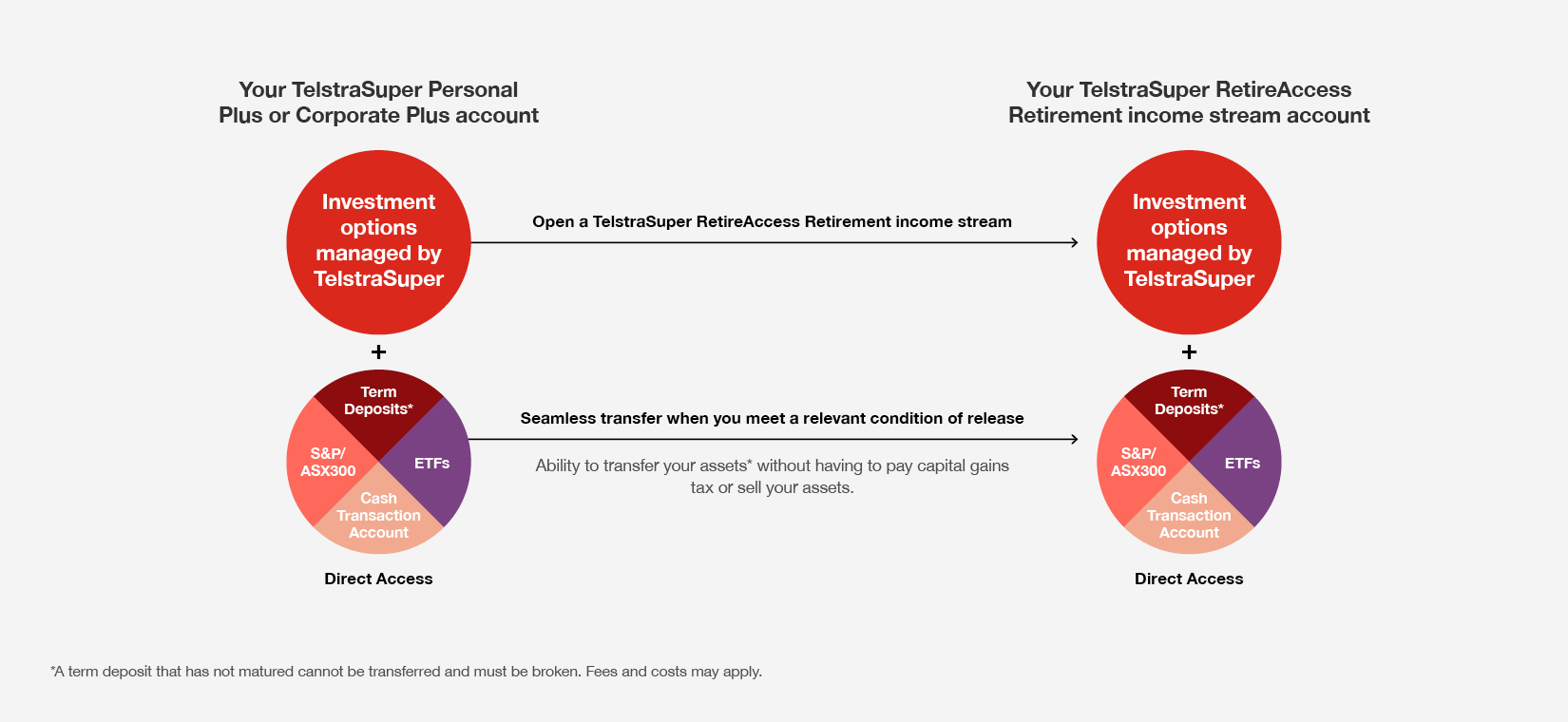

Get startedYou can remain invested in the Direct Access investment option when you reach retirement by transferring the Direct Access investments you hold* to a new Retirement income stream account^. You don’t need to sell-down or re-purchase your Direct Access investments* and you don’t pay capital gains tax or brokerage or transaction fees*.

When you open a Retirement income stream account, you can request a transfer and we’ll move the entire balance of your Direct Access investments (except any term deposits*) from your Personal Plus or Corporate Plus† account to your Retirement income stream account^. If you hold any term deposits, you will be unable to complete the transfer and can either wait until the term deposit matures or you can break the term deposit under limited circumstance (please refer to the Direct Access Guide). Where a term deposit is broken, a reduced rate of interest may be applied.

Your entire Direct Access investment balance* must be transferred across. Partial Direct Access transfers are not possible.

To be eligible to open a Retirement income stream account and transfer all* of your Direct Access investments from your Personal Plus or Corporate Plus† account, you need to

• Transfer a minimum total balance of $50,000 to your Retirement income stream account#

• The initial balance of your Direct Access investments must be at least $10,000 (which includes a minimum balance of $200 in the Cash Transaction Account (CTA) at all times)

• Invest $10,000 or the equivalent of 24 months’ worth of income payments (whichever is greater), in TelstraSuper investment option(s) other than Direct Access investments at all times.

Please refer to the TelstraSuper RetireAccess Product Disclosure Statement and Direct Access guide for further information.

If you want to transfer your Direct Access investments* to RetireAccess, you need to open a Retirement income stream account^.

If you already have a Retirement income stream account, you will need to open a new one for your Direct Access investments to be transferred into^.

Complete the online RetireAccess application form. You can conduct a full or partial transfer of your investments to your Retirement income stream account^. However, if you choose to transfer your Direct Access investments, all of your Direct Access investments must be transferred*.

For eligibility and other criteria, see above and the TelstraSuper RetireAccess PDS and Direct Access Guide.

^Excludes Transition to retirement income stream accounts and Term allocated pensions. Also excludes Retirement income stream accounts with a reversionary beneficiary nomination. Other eligibility criteria and terms and conditions apply. See above and refer to the Direct Access Guide and RetireAccess PDS for details.

*Direct Access term deposits cannot be transferred to a Retirement income stream account. If you are invested in a term deposit, you will need to wait for the term deposit to mature or break the term deposit before you can transfer your Direct Access investment options to RetireAccess. Where a term deposit is broken, a reduced rate of interest may be applied.

#When commencing a Retirement income stream, you’ll be subject to the transfer balance cap. This cap is the maximum amount that can be transferred into a tax-free income stream and includes your Retirement income stream with TelstraSuper plus any amounts you may have in tax-free income streams with other super funds (including any Commonwealth Super Scheme benefit). The amount of your transfer balance cap depends on your circumstances. If you exceed the transfer balance cap, you’ll be required to reduce the amount held in a tax-free income stream. You’ll also pay tax on the excess amount, including interest. For more information visit the ATO website www.ato.gov.au

†If you are a defined benefit member and wish to open a pension account from your Voluntary Accumulation Account (VAA) or productivity account, please call us.

Before you act on any general advice in this document, you should consider whether it is appropriate to your individual circumstances. Before making any decisions, you should obtain and read the relevant Product Disclosure Statement. Past performance is no indication of future performance.