MySuper Conservative

Objective

To build an investment portfolio to achieve the stated return objective within the stated risk parameters over the specified timeframe.

Who should invest?

Those who want to maintain some growth, with a lower risk of capital loss than the MySuper Balanced or MySuper Growth options.

Investment strategy

MySuper Conservative has a bias towards defensive assets, in particular a high weighting towards Cash to minimise short term fluctuations (risk) but some exposure to growth assets for long term growth (return).

Return objective

Corporate Plus and Personal Plus members: Outperform CPI + 1% p.a.

RetireAccess members: Outperform CPI + 1.5% p.a.

Investment timeframe

3 - 10 year periods.

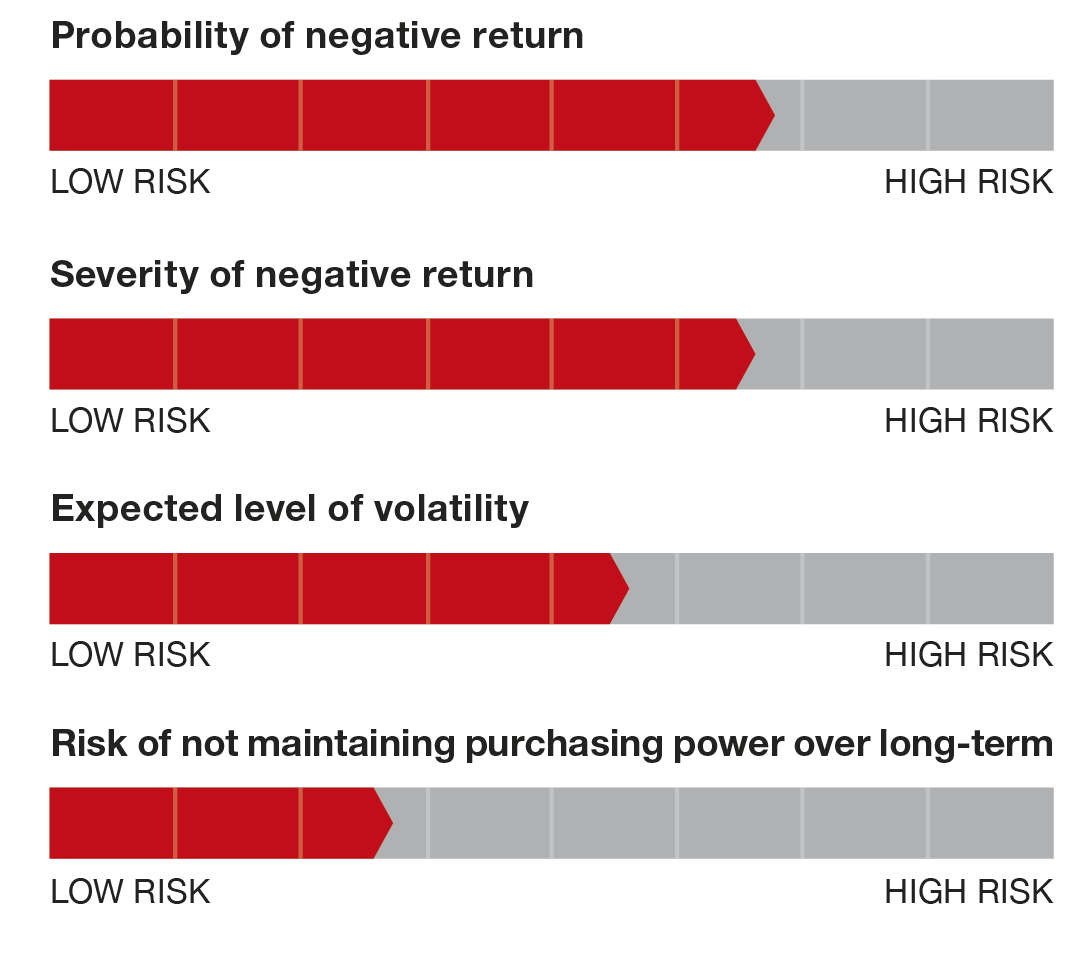

Risk characteristics

Consistent with its lower return objective, the Conservative option is expected to have the lowest level of short-term investment risk of TelstraSuper’s diversified investment options. This option’s risk characteristics using TelstraSuper’s four measures of investment risk are summarised in the diagrams below:

Conservative option’s Standard Risk Measure* is for a “low to medium” level of risk expected to generate 1 to less than 2 negative annual returns over any 20 year period.

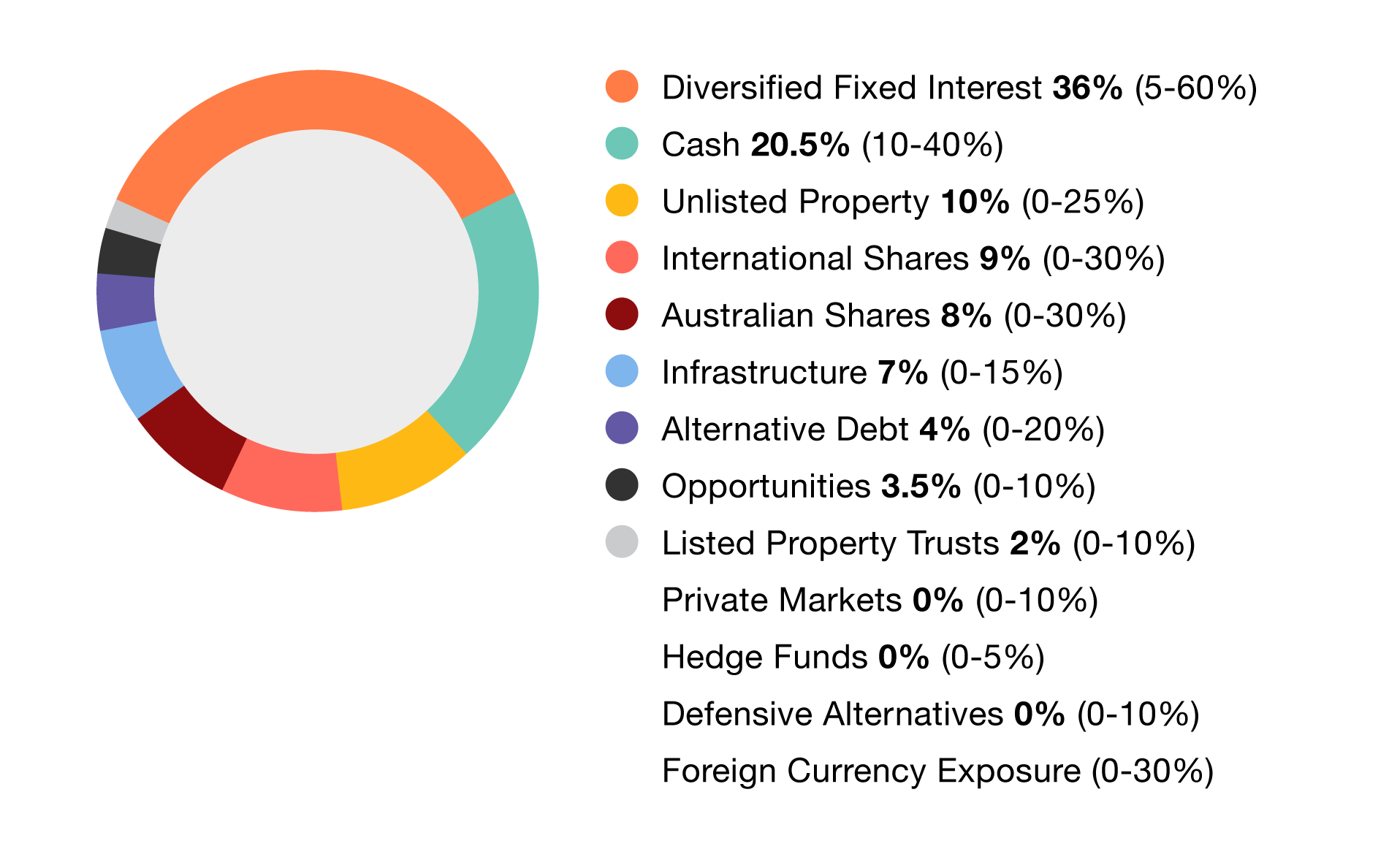

Long-term strategic investment mix^

31.3% growth assets

68.7% defensive assets

MySuper Conservative investment mix and asset ranges

The aim of this information is to provide members with investment objective and strategy details (including investment mix) that we consider members reasonably need to understand the fund's investments and reflect the manner in which objectives and strategies have been formulated by the Trustee pursuant to superannuation law and discretionary powers under the Trust Deed.

* The Standard Risk Measure is a standardised way of communicating investment risk that has been developed by the Association of Superannuation Funds of Australia (ASFA) and the Financial Services Council (FSC)

^The long-term investment mix is used as a strategic guide for investing. This split of defensive and growth assets can vary from time to time as investment in each asset class may vary within the allowable ranges.

MySuper Conservative returns†

| Timeframe | Accumulation returns |

| 2022/2023 | 8.02% |

| 2021/2022 | -0.85% |

| 2020/2021 | 9.57% |

| 2019/2020 | 0.61% |

| 2018/2019 | 5.74% |

| 2017/2018 | 5.61% |

| 2016/2017 | 7.31% |

| 2015/2016 | 3.61% |

| 2014/2015 | 7.12% |

| 2013/2014 | 10.39% |

| 2012/2013 | 10.58% |

| 2011/2012 | 3.46% |

| 5 year returns | 4.55% |

TelstraSuper MySuper Product Dashboard

The Product Dashboard is legislatively mandated and is designed to provide members with a snapshot of investment performance, risk, and fees and costs associated with TelstraSuper's MySuper Lifecycle. View the Product Dashboard.

† Past performance is not a reliable indicator of future performance. The accumulation investment returns are net of investment fees and investment taxes, but before deducting any administration fee or indirect administration cost. The TelstraSuper RetireAccess investment returns are net of investment fees but before deducting any administration fee or indirect administration cost.

Portfolio holdings disclosure

TelstraSuper is proud of our investment track record and approach to responsible investment. To provide a better understanding of what that means and how we invest our funds on behalf of our members, every 30 June and 31 December reporting date we take a “snapshot” of our portfolio holdings‡ and then break it down to show the investment allocations for each investment option. In line with current legislation, this information is made available within 90 days of each reporting date and is presented to meet the required reporting and formatting standards. For more information please see the Investments - Portfolio Holdings Disclosure section of our FAQs page.

‡ The portfolio holdings information disclosed is current only on the applicable 30 June or 31 December reporting date in a particular year. Portfolio holdings information is only updated twice a year on a date that is within 90 days after a reporting date. The portfolio holdings disclosures are made for informational purposes only and do not constitute any recommendation and/or endorsement to any person to buy or sell any investment or employ and/or implement any particular investment strategy. Any general advice on this website document has been prepared without taking into account your objectives, financial situation or needs. Before you act on any general advice in this document, you should consider whether it is appropriate to your individual circumstances. Before making any investment decision, you should obtain and read the relevant product disclosure statement. You may wish to consult a financial adviser before you make any decisions relating to your financial affairs. Past performance is no indicator of future returns.