5 popular ways to boost your super

March 28, 2024

Top up your balance and potentially pay less tax when you put extra money into your super before 30 June.

Depending on which strategy you choose and your eligibility, you could be paying less tax this tax-time. Here are 5 popular ways you could boost your super before 30 June.

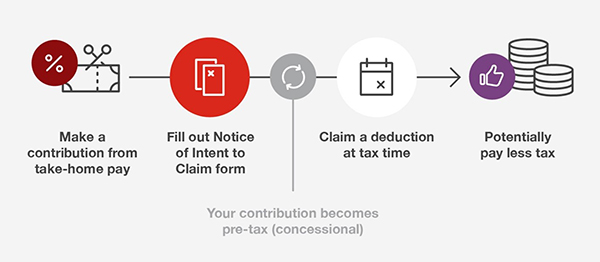

1. Contribute to your super and you could claim a tax deduction

If you’ve got a bit of spare cash, you could consider making an additional personal (post-tax) contribution to your super from your take-home pay. You could then claim a tax deduction and potentially pay less tax. Any contributions that you claim as a deduction count towards your concessional (pre-tax) contributions cap, which is $27,500^ for this financial year (if you exceed this amount, you’ll attract additional tax).

To claim your tax deduction, you’ll need to let us know prior to 30 June by submitting a ‘Notice of intent to claim’ form. You can do this by completing this form and returning it to us via email or post.

Here’s how it works:

2. Government co-contribution

Low or middle-income earners (including those who work part time) may be eligible for a government super co-contribution up to $500. To receive the government co-contribution, you’d need to make up to a $1,000 post-tax contribution.

Some rules do apply, but if you are eligible, the Australian Taxation Office (ATO) will automatically pay the money into your super account after you have lodged your tax return. There’s no paperwork to complete - the money will be automatically added to your super.

ABOUT CO-CONTRIBUTIONS

3. Salary sacrifice

If you’re a fan of ‘set and forget’ (and reaping potential tax benefits) then this could be the option for you. You can ask your employer to deduct a bit of money from your pay into your super. Those contributions are generally taxed at a lower rate of 15%* compared to your usual income, meaning you may pay less tax. This is because salary ‘sacrificed’ contributions are classified as employer super contributions, rather than personal (post tax) contributions.

There are eligibility conditions and it’s important to note that any contributions made through a salary sacrifice arrangement will count towards your concessional (pre-tax) contributions cap of $27,500^.

ABOUT SALARY SACRIFICE

4. Spouse contribution

If your spouse has a total income of $37,000 or less, contributing to their super can be an effective way to grow their retirement savings while also reducing your tax. In fact, you may be able to claim a tax offset of 18% on the first $3,000 of spouse contributions you make to their super account (up to a maximum of $540). This can be a great strategy if one person has taken time out of their career to stay at home with children or care for a family member.

If your spouse’s total income is between $37,000 and $40,000 per year, you can still claim an offset but it works on a sliding scale.

ABOUT SPOUSE CONTRIBUTIONS

5. Catch-up (carry-forward) contributions

If you have taken time off from work to care for children or a family member or if you are nearing retirement and want to maximise the amount you have in your super, then this option could be beneficial for you.

If you have a total super balance of less than $500,000 at 30 June of the previous financial year, you may be able to ‘carry-forward’ any unused concessional (pre-tax) caps for up to five years, allowing you to make additional contributions above the current yearly $27,500^ cap to ‘catch-up.’

ABOUT CATCH-UP CONTRIBUTIONS

Ready to boost your super before 30 June?

We can discuss these options with you and help find you a simple solution. To make the most of your super or finances, an adviser from TelstraSuper Financial Planning can provide you with personal advice. Fees may apply. Call us on 1300 033 166 or request a call back.

*If your income and concessional contributions are under $250,000. If your income and concessional contributions are over $250,000, then contributions made on the amount in excess of $250,000 will be taxed at an additional 15%. For more information, visit the ATO website.