Hi I’m Amy Waite from the TelstraSuper investments team and today we’re going to take a closer look at inflation and how it impacts your super.

When prices rise on average in an economy, it’s called Inflation. Inflation is caused by the overall demand for products and services- the greater the demand, the more the price will increase. The most well-known indicator of inflation is the Consumer Price Index, or ‘CPI’, which measures the percentage change in the price of a basket of goods and services consumed by households.

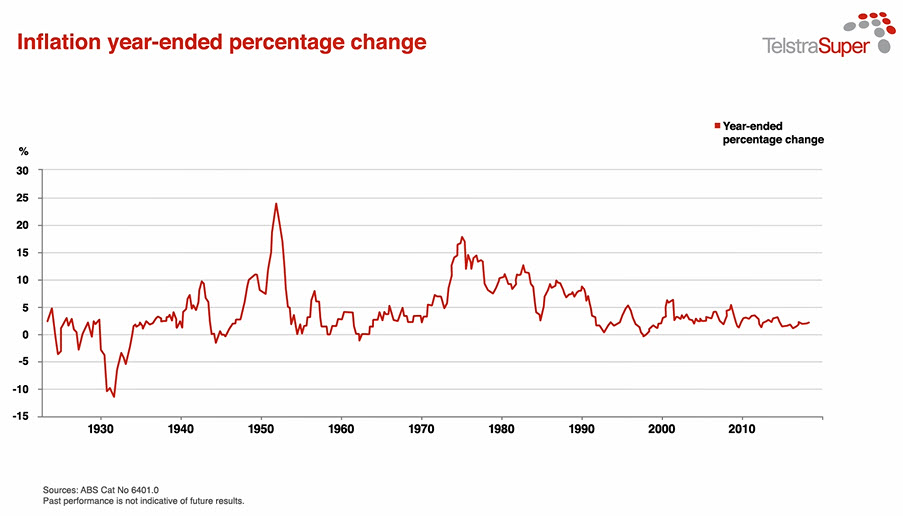

In Australia, the Reserve Bank of Australia, ‘the RBA’, is responsible for keeping inflation under control and has a target inflation rate between 2 and 3%. Currently we’re having the longest period of low inflation since the 1990’s.

Inflation affects everyone differently as people have their own spending habits and costs of living.

So how does inflation impact your superannuation? If inflation is at 2%, to maintain your spending habits, your super return must be at least 2% to keep up with your spending. Therefore, if your return is 8% per annum, your return, adjusted for inflation, is 6% per annum. With current inflation levels low and strong investment returns, your super nest egg is growing at a faster pace than inflation. In retirement your savings will be more likely to maintain your standard of living if your investments generate returns higher than inflation over the medium to long term. This is something we call inflation risk.

In extreme cases, inflation can get out of control which was the case in Zimbabwe which had 100 trillion dollar notes in circulation!

You can check out the latest returns for your super by visiting our website telstrasuper.com.au. We look forward to sharing more investment insights with you.